✅ A possible model solution for the W10 summative

What follows is a possible solution for the W10 summative. If you want to render the .qmd that was used to generate this page for yourselves, use the download button below:

Note that I purposely avoided very elaborate solutions here and I’ve avoided optimizing the performance of the models to death. I tried to go for rather straightforward but justified solutions.

⚙️ Setup

We start, as usual, by loading libraries.

import pandas as pd

import missingno as msno

import sweetviz as sv

import numpy as np

from sklearn.preprocessing import MinMaxScaler

from sklearn.linear_model import LinearRegression

from sklearn.model_selection import TimeSeriesSplit

from sklearn.model_selection import TimeSeriesSplit, RandomizedSearchCV, learning_curve

from sklearn.utils.class_weight import compute_class_weight

from sklearn.preprocessing import StandardScaler

from sklearn.linear_model import LogisticRegression

from sklearn.ensemble import RandomForestRegressor

import lightgbm as lgb

import re

from sklearn.metrics import r2_score, mean_absolute_error,f1_score, precision_score, recall_score, roc_auc_score,average_precision_score, balanced_accuracy_score, roc_curve, precision_recall_curve,confusion_matrix

from lets_plot import *

LetsPlot.setup_html()Part 1

Question 1

Loading the data requires the read_stata() method from from pandas (see the pandas documentation).

yuan = pd.read_stata('../../data/yuan_inflation_data.dta')msno.matrix(yuan)

report = sv.analyze(yuan)

report.show_notebook()This dataset is clean and does not have any missing values. The scales of the variables vary widely (nominal money issues is in the millions for example). Some variables are skewed (e.g CPI, nominal money issues and total wars).We have a mix of numerical and categorical variables (emperorname is categorical).

def plot_hist_with_density(df, col):

return (

ggplot(df) +

geom_histogram(aes(x=col, y='..density..'), bins=30, fill='#547AB0', color='black', alpha=0.6) +

geom_density(aes(x=col), color='#547AB0', size=1.2,alpha=0.3) +

ggtitle(f'Distribution of {col}\n with Density Overlay') +

theme_minimal()

)

# Step 2: Variables to visualize

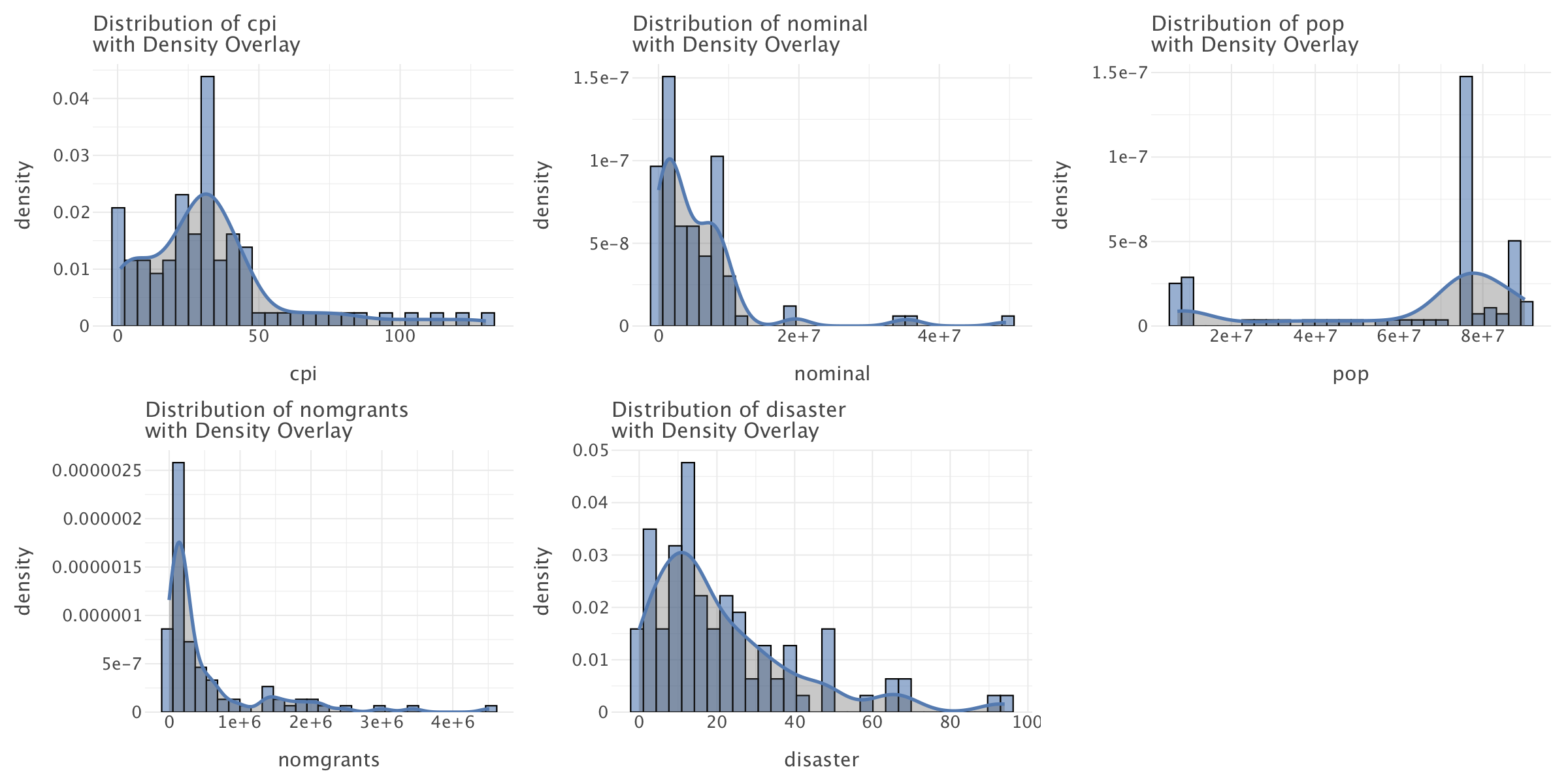

vars_to_plot = ['cpi', 'totalwar', 'nominal', 'pop', 'nomgrants', 'disaster']plots = [plot_hist_with_density(yuan, var) for var in vars_to_plot]

gggrid(plots, ncol=3)

Most of the variables in the dataset do not follow a normal distribution and most follow an exponential distribution (e.g totalwar,nominal,cpi,nomgrants,disaster). This is likely reflective of a state where a spiralling economic and political crisis gradually took hold until the dynasty collapsed.

def plot_line(df, col, color):

match col:

case 'cpi':

y_label = 'CPI (%)'

case 'nominal':

y_label = 'Nominal Money Issues'

case 'pop':

y_label = 'Population'

case 'nomgrants':

y_label = 'Number of Imperial Grants'

case 'disaster':

y_label = 'Number of Disasters'

case _:

y_label = 'Unknown'

return (

ggplot(df) +

geom_line(aes(x='year', y=col),color=color) +

geom_point(aes(x='year', y=col),color=color) +

ggtitle(f'Evolution of {y_label} for most of \nthe Yuan dynasty (1260-1355)') +

scale_x_continuous(name='Year', breaks=sorted(df['year'].unique()), labels=[str(y) for y in sorted(df['year'].unique())])+

ylab(y_label)+

theme_minimal()

)

# Step 2: Variables to visualize

vars_to_plot = ['cpi', 'nominal', 'pop', 'nomgrants', 'disaster']

colors = ['#3EB489', '#e6a817', '#4682b4', '#b53389', '#ed2939']

plots = [plot_line(yuan, var,color) for var,color in zip(vars_to_plot,colors)]

g=gggrid(plots, ncol=2)

g+=ggsize(1400,1200)

g.show()

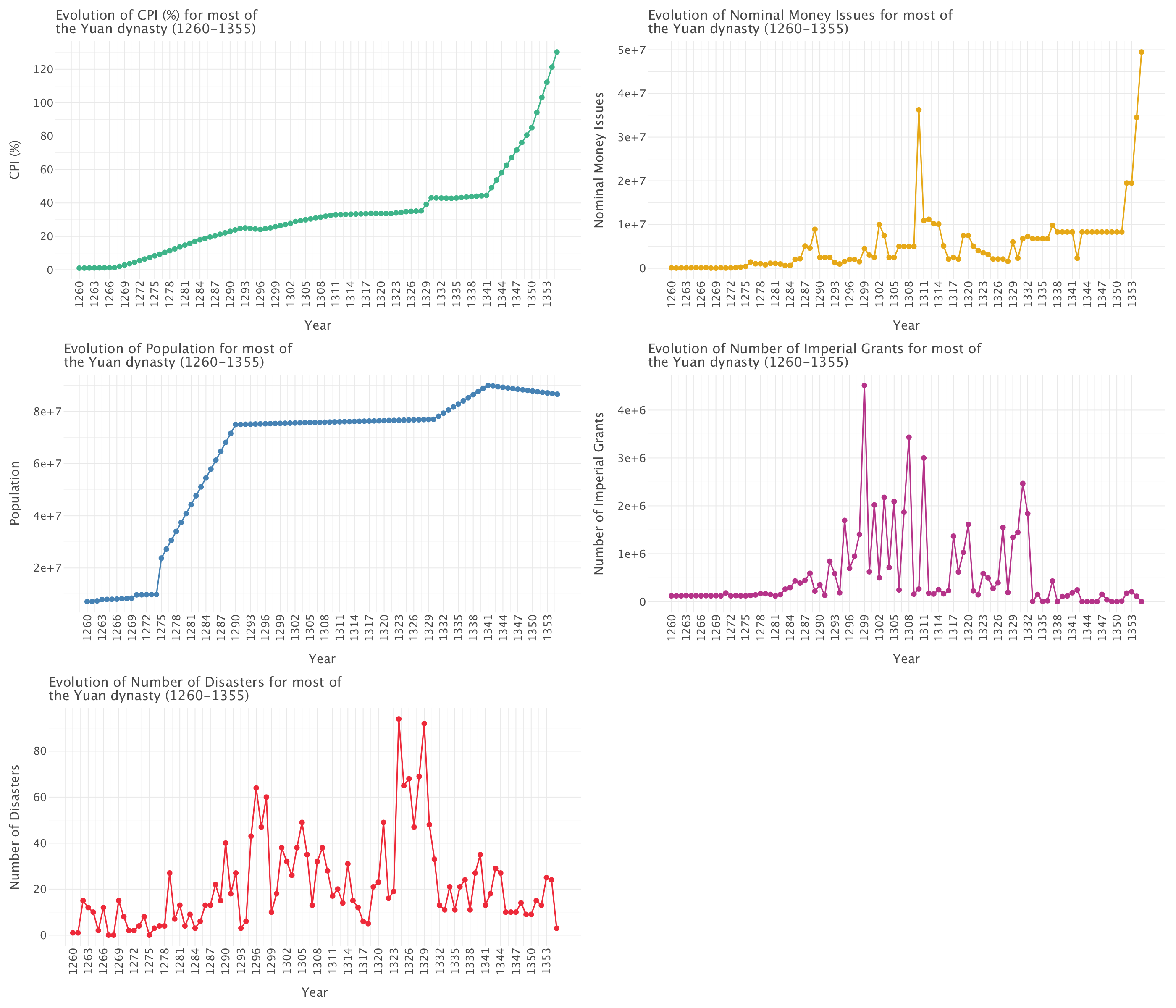

This graph allows to examine five critical indicators that track the rise and fall of the Yuan dynasty, revealing classic patterns of dynastic cycle in imperial China.

Consumer Price Index (CPI)

- Pattern: Three distinct phases:

- Gradual increase (1260-1300)

- Plateau/slight increase (1300-1340)

- Dramatic exponential increase (1340-1355)

- Interpretation: The final phase exhibits classic exponential growth characteristics as the curve steepens dramatically, indicating severe monetary instability and economic breakdown toward the dynasty’s end.

Nominal Money Issues

- Pattern: Initially low and stable, with sporadic printing showing spikes around 1310, followed by enormous increases after 1350.

- Interpretation: The massive currency expansion aligns perfectly with the CPI surge, suggesting monetary overexpansion that fueled runaway inflation as the dynasty approached collapse.

Population

- Pattern: Four distinct phases:

- Modest initial level (~10 million, 1260-1275)

- Sharp increase between 1275-1290 (quadrupling to ~70-75 million)

- Long plateau (1290-1330)

- Final peak around 1340, followed by slight decline

- Interpretation: This follows a logistic growth curve (S-curve) rather than simple exponential growth. The rapid early growth reflects initial stability and prosperity under Mongol rule, while the plateau suggests reaching agricultural and administrative carrying capacity. The late decline correlates with economic crisis and conflicts.

Imperial Grants

- Pattern: Relatively flat early on, then fluctuating significantly with major spikes particularly around 1310-1320.

- Interpretation: Likely indicates administrative or political instability, with grants used strategically to secure loyalty or reward service during increasingly turbulent times.

Number of Disasters

- Pattern: Considerable volatility with major peaks around 1290 and dramatic spikes during 1320-1330.

- Interpretation: Reflects increasing natural or human-made disasters, potentially compounding internal stressors and undermining state capacity.

The Classic Dynastic Cycle

The data presents a textbook example of the dynastic cycle in Chinese history: 1. Early Stability and Growth (1260-1290): Characterized by population expansion and modest inflation 2. Middle Period Challenges (1290-1340): Marked by fluctuating imperial grants and increased disasters 3. Final Period of Severe Instability (1340-1355): Defined by exponential inflation, currency devaluation, and demographic decline

The correlation between rising inflation, increased money printing, and growing rebellions (as seen in the war types graph below) in the final decades points directly to the economic and political breakdown that ultimately led to the dynasty’s fall in 1368. This pattern exemplifies how economic mismanagement and internal instability can accelerate dynastic decline.

# Step 1: Prepare the data for the stacked bars

war_types = ['rebellion', 'external', 'unification']

df_long = yuan.melt(id_vars='year', value_vars=war_types, var_name='war_type', value_name='count')

# Ensure year is treated as a categorical variable for plotting

df_long['year'] = df_long['year'].astype(str)

# Step 2: Prepare the data for the totalwar line plot

df_totalwar = yuan[['year', 'totalwar']].copy()

df_totalwar['year'] = df_totalwar['year'].astype(str)

# Step 3: Plot the stacked bars and totalwar line

p = (

ggplot() +

# Stacked bar plot

geom_bar(aes(x='year', y='count', fill='war_type'), data=df_long, stat='identity') +

# Line for totalwar

geom_line(aes(x='year', y='totalwar'), data=df_totalwar, color='black', size=1.2) +

# Points for totalwar

geom_point(aes(x='year', y='totalwar'), data=df_totalwar, color='black', size=2) +

ggtitle('Evolution of war types during the Yuan dynasty\n and relationship between totalwar and other war-related variables') +

xlab('Year') +

ylab('Count') +

theme(axis_text_x=element_text(angle=90, hjust=1))+

ggsize(1200,800)

)

p

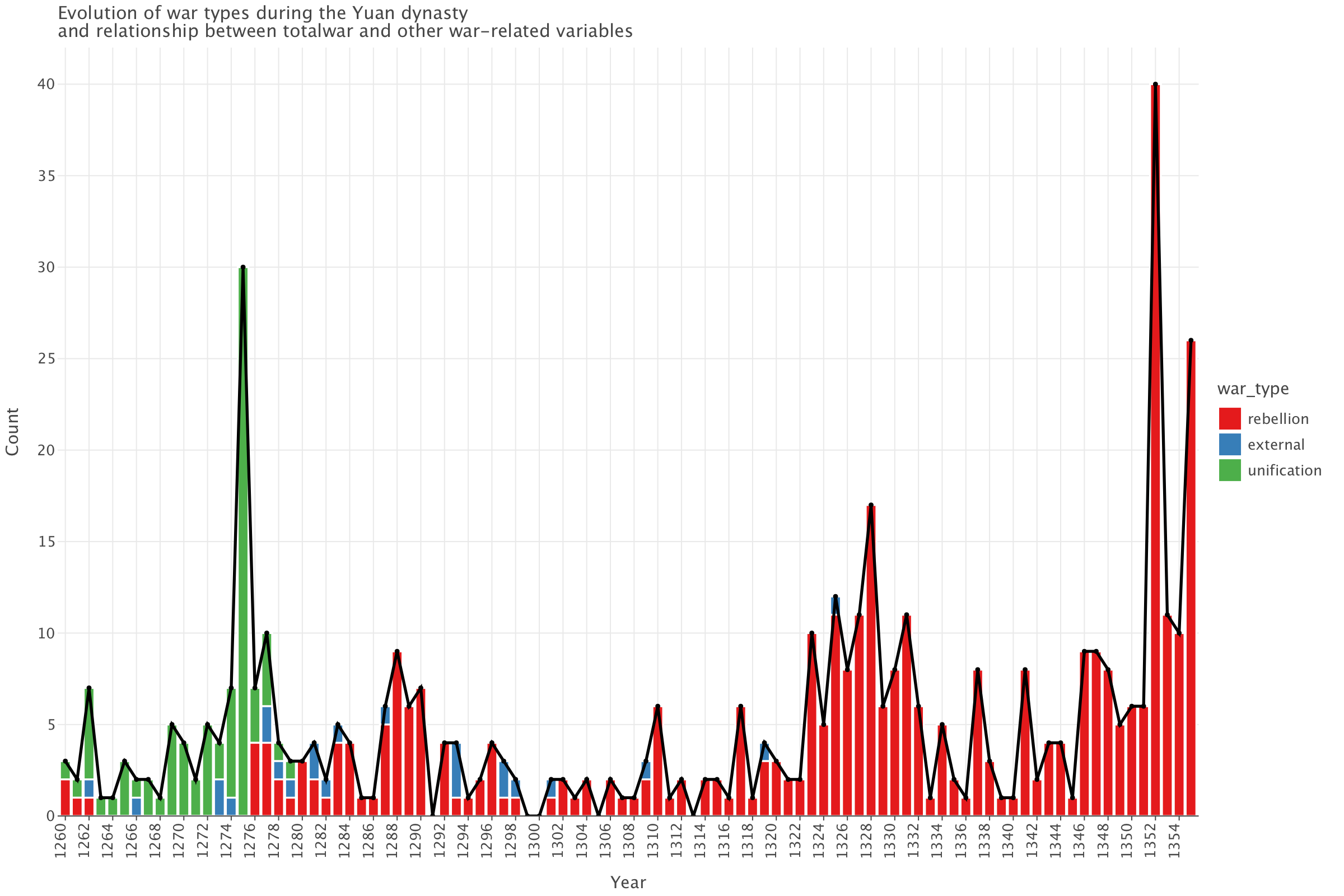

The nature of wars changes during the course of the Yuan dynasty: most of the wars are unification wars (led against remnants of the Song dynasty) until around 1278. From then on, it’s mostly rebellions. Quite remarkably, the Yuan waged relatively few external wars. This graph also shows three distinct periods:

- 1260-1278: a period characterized by an an increase in wars (mainly of unification against remnants of the Song) with a peak in 1275

- 1279-1322: a period of relative stability with relatively few wars per year

- 1323-1355: a period where the number of wars (mainly rebellions) steadily increases signalling worsening political crisis and instability (which eventually led to the fall of the dynasty in 1368)

And finally, the graph demonstrates that totalwar=external+rebellion+unification

Question 2

Top 10 years with most wars/disasters and overlap with highest nominal money issues

# Get top 10 years for total wars, nominal money issues, and disasters

top_wars = yuan.nlargest(10, 'totalwar')[['year', 'totalwar']]

top_money = yuan.nlargest(10, 'nominal')[['year', 'nominal']]

top_disasters = yuan.nlargest(10, 'disaster')[['year', 'disaster']]

# Find overlapping years

overlapping_war_money = set(top_wars['year']).intersection(set(top_money['year']))

overlapping_disaster_money = set(top_disasters['year']).intersection(set(top_money['year']))

# Print results

print(f"Top 10 years with most total wars:\n{top_wars}")

print(f"Top 10 years with most nominal money issues:\n{top_money}")

print(f"Top 10 years with most disasters:\n{top_disasters}")

print(f"Years with both high wars and high nominal money issues: {overlapping_war_money}")

print(f"Years with both high disasters and high nominal money issues: {overlapping_disaster_money}")Top 10 years with most total wars:

year totalwar

92 1352 40

15 1275 30

95 1355 26

68 1328 17

65 1325 12

67 1327 11

71 1331 11

93 1353 11

17 1277 10

63 1323 10

Top 10 years with most nominal money issues:

year nominal

95 1355 49500000

50 1310 36259200

94 1354 34500000

92 1352 19500000

93 1353 19500000

52 1312 11211680

51 1311 10900000

53 1313 10200000

54 1314 10100000

42 1302 10000000

Top 10 years with most disasters:

year disaster

64 1324 94

69 1329 92

68 1328 69

66 1326 68

65 1325 65

36 1296 64

38 1298 60

45 1305 49

61 1321 49

70 1330 48

Years with both high wars and high nominal money issues: {1352, 1353, 1355}

Years with both high disasters and high nominal money issues: set()Analysis of the years of overlap between high number of wars and high number of nominal issues

There is an overlap between high numbers of wars and high nominal money issues in the years 1352, 1353, and 1355:

- 1352: 40 wars with 19,500,000 in nominal money issues

- 1353: 11 wars with 19,500,000 in nominal money issues

- 1355: 26 wars with the highest money issuance of 49,500,000

This period falls during the final decades of Yuan rule when the dynasty was experiencing significant instability. The data suggests an escalating crisis where the government was likely printing more currency to finance military efforts against growing rebellions, particularly the Red Turban Rebellion which began around 1351 (and ended up overthrowing the Yuan).

Relationship between warfare and money issuance

Three possible relationships between warfare and money issuance emerge:

- Military campaigns necessitated increased money issuance to fund armies

- Economic instability from excessive money issuance contributed to social unrest and conflict

- Both factors reinforced each other in a negative cycle

The massive increase in money issuance during these years (especially the jump to 49,500,000 in 1355) would have likely caused severe inflation. Historical accounts confirm that by the late Yuan period, paper money had depreciated dramatically, aligning with your data showing unprecedented levels of issuance.

Analysis of the spike in money issuance around 1310-1314

There’s an interesting spike in money issuance around 1310-1314, which doesn’t correspond with high levels of warfare or disasters. This might represent an earlier attempt at economic stimulus or financial reorganization that preceded the later crisis.

Disaster Patterns

Interestingly, there’s no overlap between years with high disasters and high nominal money issues. This might indicate that natural disasters didn’t directly drive monetary policy.

While disasters don’t overlap with money issuance, they do cluster in the 1320s (particularly 1324-1329). These natural disasters may have weakened the dynasty’s economic foundation and administrative capacity before the more acute military crises of the 1350s.

The temporal sequence suggests that financial mismanagement (possibly beginning with the 1310s issuance spike) may have contributed to economic instability, which later combined with natural disasters and eventually erupted into widespread rebellion in the 1350s.

Administrative Breakdown

The extremely high money issuance in 1354-1355 might indicate a last-ditch effort to maintain control as the dynasty approached collapse. This pattern of governance breakdown shows the Yuan government responding to challenges with increasingly desperate financial measures. The data supports historical accounts that the late Yuan government resorted to excessive money printing while simultaneously dealing with widespread rebellion, ultimately contributing to its downfall in 1368.

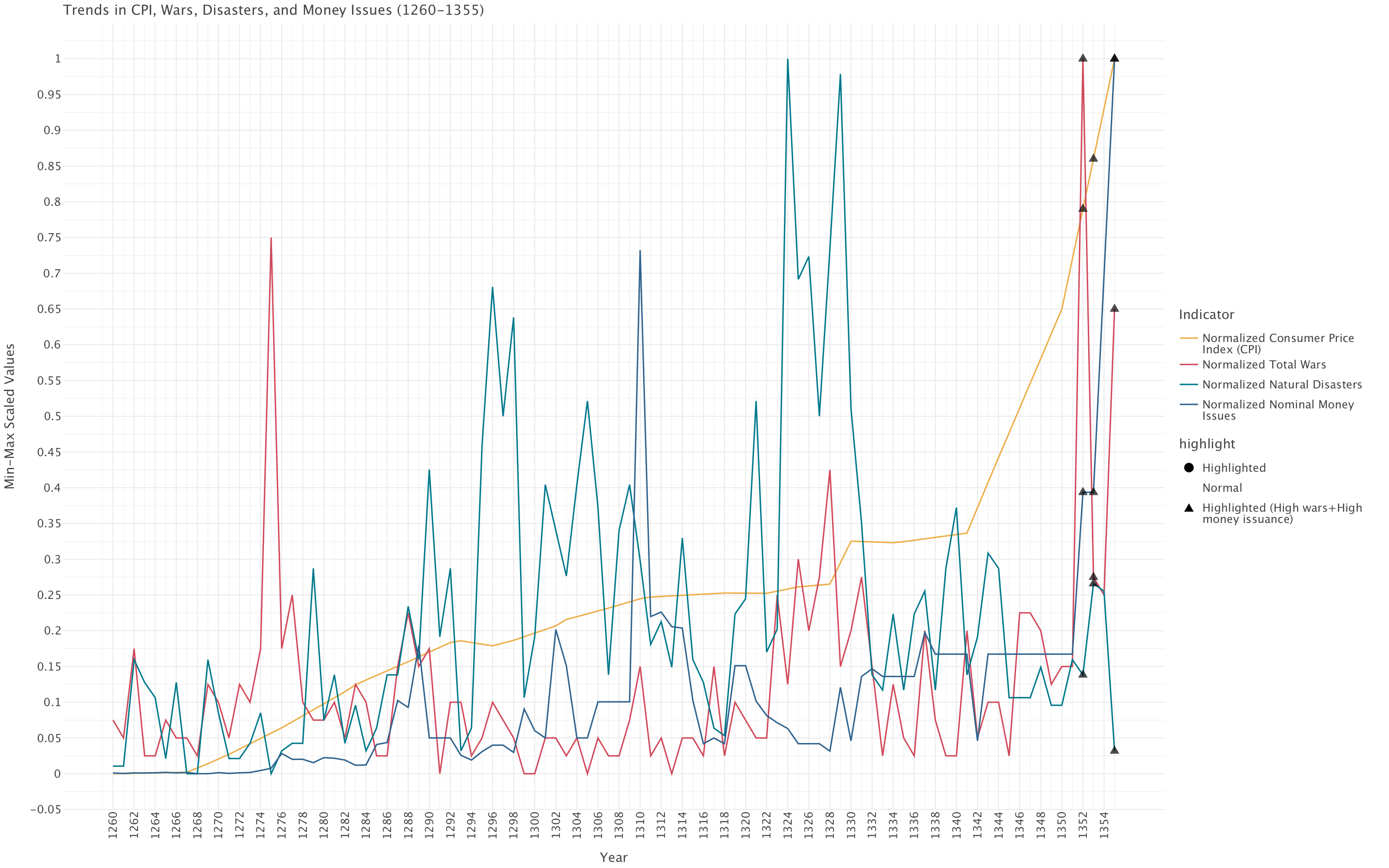

Evolution over time of CPI, total wars, disasters and nominal money issues

# Initialize Min-Max Scaler

scaler = MinMaxScaler()

# Apply Min-Max Scaling to relevant columns

scaled_cols = ['cpi', 'totalwar', 'disaster', 'nominal']

yuan_scaled = yuan.copy()

yuan_scaled[scaled_cols] = scaler.fit_transform(yuan[scaled_cols])

# Highlight key years in the dataset

highlight_years = {1352, 1353, 1355} # Years with both high wars & high money issuance

yuan_scaled['highlight'] = yuan_scaled['year'].apply(lambda x: 'Highlighted (High wars+High money issuance)' if x in highlight_years else 'Normal')

# Convert to long format

yuan_melted = yuan_scaled.melt(id_vars=['year', 'highlight'], value_vars=scaled_cols, var_name='Variable', value_name='Value')

# Create a mapping for more explicit legend labels

legend_labels = {

'cpi': 'Normalized Consumer Price Index (CPI)',

'totalwar': 'Normalized Total Wars',

'disaster': 'Normalized Natural Disasters',

'nominal': 'Normalized Nominal Money Issues'

}

# Replace variable names with explicit labels

yuan_melted['Variable'] = yuan_melted['Variable'].map(legend_labels)

# Define custom color mapping

custom_colors = {

'Normalized Consumer Price Index (CPI)': '#edae49',

'Normalized Total Wars': '#d1495b',

'Normalized Natural Disasters': '#00798c',

'Normalized Nominal Money Issues': '#30638e'

}

# Assign smaller sizes to points

size_mapping = {'Highlighted': 5, 'Normal': 0} # Set highlighted points to size 5, normal to invisible (0)

# Create plot

plot = (ggplot(yuan_melted) +

geom_line(aes(x='year', y='Value', color='Variable')) +

geom_point(aes(x='year', y='Value', shape='highlight', size='highlight'),

color='black', alpha=0.7) +

scale_size_manual(values=size_mapping) + # Set smaller highlight point size

scale_color_manual(values=custom_colors) + # Apply custom colors

scale_x_continuous(name='Year', breaks=sorted(yuan['year'].unique()), labels=[str(y) for y in sorted(yuan['year'].unique())])+

labs(title="Trends in CPI, Wars, Disasters, and Money Issues (1260-1355)",

x="Year", y="Min-Max Scaled Values", color="Indicator") + # Change legend title

theme_minimal())

plot += ggsize(1600,1000)

plot.show()

Before plotting the different variables in our data, we apply min-max scaling. Why is that?

- Our variables (disasters: 0-94, nominal money: 22.9K-49.5M, wars: 0-40, CPI: 1-130) have drastically different scales. Min-max scaling brings them all to a common [0,1] range, allowing us to directly observe relative movements and turning points.

- We’re analyzing relationships between wars, money issuance, disasters, and inflation. Min-max scaling helps identify temporal relationships (does money issuance peak before or after war events?) by normalizing amplitude differences.

- For historical analysis, understanding when variables reached their relative maximums and minimums is often more informative than their absolute values. Min-max scaling emphasizes these relative positions.

Comparison with Alternative Methods

Log transformation

We wouldn’t be able to apply the log transformation here: some variables (e.g disasters, wars) have zero values, which a log transformation can’t handle. On top of this, while a log transformation works well for exponential data like CPI, it would inappropriately compress the count data (wars, disasters) which isn’t exponentially distributed.

Standardization

Standardization would only be appropriate if the variables we were plotting followed a normal distribution: none of the variables we have do. On top of this, standardization would center our variables around their means, but variables with similar means but different variances would still be difficult to compare visually.

Interpretation of the plot

Based on this plot, several key patterns emerge:

End-of-Dynasty Crisis (1350-1355): The most striking feature is the dramatic spike in all indicators at the very end of the period. Wars (red line) and money issues (blue line) both reach their absolute maximum in the 1350s, while CPI (yellow line) shows a steep upward trajectory. This aligns with the historical collapse of the Yuan dynasty, suggesting a desperate government resorting to massive currency issuance to fund military campaigns against rebellions.

Disaster Patterns: Natural disasters (teal line) show several pronounced peaks throughout the period, with particularly intense clusters around 1290s, 1310s, and especially the 1320s. The highest disaster peaks (reaching near 1.0 on the scale) occur in what appears to be the 1320s.

Monetary Policy Evolution: Nominal money issues show relatively modest levels until approximately 1310, after which we see more frequent and larger spikes. This suggests a potential shift in fiscal policy (and begs the question about governance) around this time.

Inflation Trend: The CPI (yellow line) shows a generally steady upward trajectory throughout the entire period, with acceleration in the final decades. This continuous inflationary trend likely undermined economic stability over time.

Correlation Patterns:

- Wars and money issues show correlation at several points, particularly at the dynasty’s end

- Disasters do not consistently correlate with immediate money issuance

- The highlighted triangles at the end mark years with both high wars and high money issuance

Earlier War Spike: There’s a notable isolated spike in wars (red line) around 1275-1280, which doesn’t correspond with equivalent increases in money issuance. This mainly corresponds to the last wars of the Yuan with the remnants of the Song dynasty but could also represent external conflicts: the common characteristic here is that these conflicts were managed without extraordinary monetary measures.

The visualization effectively demonstrates how the dynasty experienced a catastrophic convergence of factors in its final years - escalating warfare, unprecedented money issuance, and accelerating inflation - creating a perfect storm that likely contributed to its downfall in 1368.

Part 2

Question 1

We exclude emperor and emperorname from the modeling as they do not provide meaningful information for the regression analysis. Given that totalwar=external+rebellion+unification, we can choose to either keep totalwar on its own or drop totalwar and keep external, rebellion and unification instead. Since knowing which types of wars the Yuan were engaged in at any point in time might be more informative than simply taking into account the total number of wars, in this analysis, we’ll keep external, rebellion and unification and drop totalwar.

yuan_reduced = yuan.drop(columns=['emperor','emperorname','totalwar'])Let’s split the data in training and test sets

training, test = (yuan_reduced.query(f'year {op} 1327') for op in ('<', '>='))target = 'cpi'

features = [col for col in yuan_reduced.columns if col not in [target,'year']]# Train the Model

model = LinearRegression()

model.fit(training[features], training[target])

# Predictions

training['predicted_cpi'] = model.predict(training[features])

test['predicted_cpi'] = model.predict(test[features])

# Evaluate Performance

metrics = {

"Set": ["Training", "Test"],

"R²": [r2_score(training[target], training['predicted_cpi']), r2_score(test[target], test['predicted_cpi'])],

"MAE": [mean_absolute_error(training[target], training['predicted_cpi']), mean_absolute_error(test[target], test['predicted_cpi'])]

}

metrics_df = pd.DataFrame(metrics)

print(metrics_df)

# Residual DataFrames

training['residuals'] = training[target] - training['predicted_cpi']

test['residuals'] = test[target] - test['predicted_cpi']

# Combine for Plotting

residuals_df = pd.concat([training.assign(Set='Training'), test.assign(Set='Test')])

# Residual Plot

plot = (ggplot(residuals_df) +

geom_point(aes(x='predicted_cpi', y='residuals', color='Set'), alpha=0.7) +

geom_hline(yintercept=0, linetype="dashed", color="red") +

labs(title="Residual Plot for Baseline Linear Regression",

x="Predicted CPI", y="Residuals") +

theme_minimal())

plot.show()Set R² MAE

0 Training 0.932165 2.558541

1 Test -0.921603 27.854257

/var/folders/5s/2df7vjxs371f0f47gzlnsjg40000gp/T/ipykernel_78851/2733624378.py:6: SettingWithCopyWarning:

A value is trying to be set on a copy of a slice from a DataFrame.

Try using .loc[row_indexer,col_indexer] = value instead

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

training['predicted_cpi'] = model.predict(training[features])

/var/folders/5s/2df7vjxs371f0f47gzlnsjg40000gp/T/ipykernel_78851/2733624378.py:7: SettingWithCopyWarning:

A value is trying to be set on a copy of a slice from a DataFrame.

Try using .loc[row_indexer,col_indexer] = value instead

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

test['predicted_cpi'] = model.predict(test[features])

/var/folders/5s/2df7vjxs371f0f47gzlnsjg40000gp/T/ipykernel_78851/2733624378.py:20: SettingWithCopyWarning:

A value is trying to be set on a copy of a slice from a DataFrame.

Try using .loc[row_indexer,col_indexer] = value instead

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

training['residuals'] = training[target] - training['predicted_cpi']

/var/folders/5s/2df7vjxs371f0f47gzlnsjg40000gp/T/ipykernel_78851/2733624378.py:21: SettingWithCopyWarning:

A value is trying to be set on a copy of a slice from a DataFrame.

Try using .loc[row_indexer,col_indexer] = value instead

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

test['residuals'] = test[target] - test['predicted_cpi']

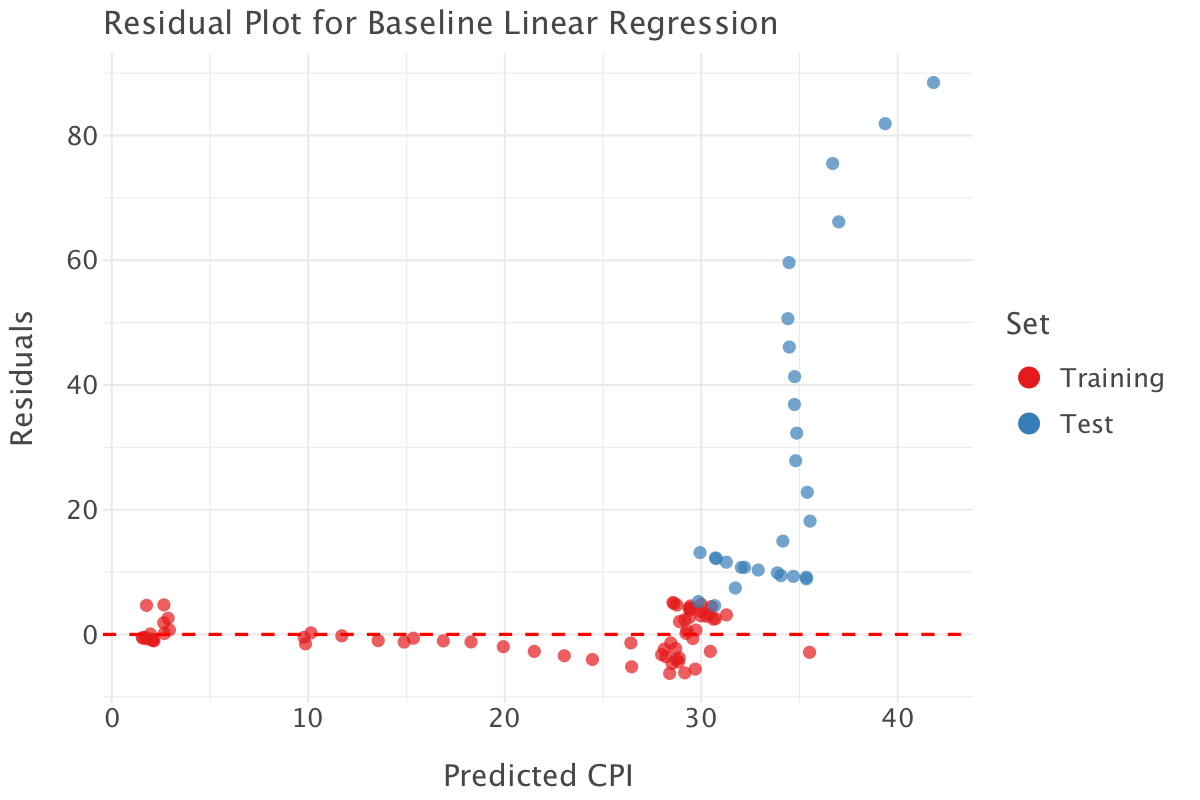

Interpretation of the metrics and residual plot

R² Scores

- Training R² = 0.932 : The model explains 93.21% of the variance in

cpifor the training set. This suggests an excellent fit. - Test R² = -0.921 : A negative R² means that the model performs worse than just predicting the mean on the test set. This is a strong sign of overfitting.

MAE

- Training MAE = 2.55: On average, the model’s predictions in the training set deviate from actual CPI by 2.55 units. Given that the scale of CPI goes from 1 to 130, this looks like a decent performance.

- Test MAE = 27.85: The test set error is almost 11× larger, meaning the model generalizes very poorly.

Residual Plot Analysis

- Training Residuals (Red Points):

- Residuals are small and centered around 0, which suggests a good fit on the training data.

- Test Residuals (Blue Points):

- A clear pattern emerges, especially for high predicted values.

- Test residuals increase dramatically at higher CPI values, indicating the model fails to generalize for later years.

Why is This Happening?

- Overfitting: The model fits the training data too well but doesn’t generalize to unseen data.

- Non-Linearity: The relationship between features and CPI is not truly linear.

- Exponential Growth in CPI: CPI increases rapidly in later years (clear pattern of hyperinflation), but a simple linear regression can’t capture this trend.

How could we improve things?

If we were intent on using a linear model:

- we could try using a log transformation on CPI:

- Since CPI grows exponentially, applying a log transform (

log(cpi)) may make the relationship more linear (also consider applying a log or a Yeo-Johnson transformation on skewed variables depending on whether they are positive or have negative or zero values).

- Since CPI grows exponentially, applying a log transform (

- we could also use regularization techniques (Ridge/Lasso Regression):

- These models prevent overfitting by penalizing large coefficients.

More generally, we should consider:

- using time-aware cross-Validation**:

- our current train-test split is based on time but captures very specific and distinct patterns in the training and test sets, so applying rolling or expanding window cross-validation would better reflect how the model performs on future data.

- trying non-linear models:

- the residual plots helped us uncover non-linear patterns in our data. Non-linear models would better capture these dynamics and complex relationships uncovered. We could, for example, try tree ensembles e.g random forest, or boosted trees such as XGBoost as they require minimal pre-processing, tend to have good performance out-of-the-box and retain some explainability.

Question 3

Since we picked up non-linear patterns in the the residual plots in the previous model, we’ll use a Random Forest model to try and improve our baseline model. We’ll also implement expanding window cross-validation and tune the model parameter for more robust model selection/validation. We have to use time-aware cross-validation as we would otherwise expose ourselves to data leakage (e.g predicting the past with the future!).

# Define Time-Aware Cross-Validation

#5-fold expanding window

tscv = TimeSeriesSplit(n_splits=5) # Initialize Random Forest Regressor

rf = RandomForestRegressor(random_state=42, n_jobs=-1)We implement hyperparameter tuning for your Random Forest model using a randomized search approach. A randomized search approach is computationally more efficient than a an exhaustive grid search. By default, RandomizedSearchCV (just like GridSearchCV) tries to maximize the scoring metric: so if we want to minimize the MAE scoring metric i.e for it to be as low as possible, we need to maximize the negative MAE score i.e neg_mean_absolute_error! This code block returns the set of hyperparameters that produce the best performance wrt the scoring metric on average.

# Define hyperparameter grid

param_grid = {

'n_estimators': [100, 300, 500, 800], # Number of trees

'max_depth': [None, 10, 20, 30], # Depth of each tree

'min_samples_split': [2, 5, 10], # Minimum samples required to split a node

'min_samples_leaf': [1, 2, 4], # Minimum samples at a leaf node

'max_features': ['sqrt', 'log2'], # Number of features per split

}

# Perform Randomized Search with Time-Series CV

rf_random = RandomizedSearchCV(

estimator=rf,

param_distributions=param_grid,

n_iter=20, # Number of combinations to try

cv=tscv,

scoring='neg_mean_absolute_error',

n_jobs=-1,

random_state=42

)

# Fit the model

rf_random.fit(training.drop(columns=['year', 'cpi','predicted_cpi','residuals']), training['cpi'])

# Get best parameters

best_params = rf_random.best_params_

print("Best Hyperparameters:", best_params)Best Hyperparameters: {'n_estimators': 100, 'min_samples_split': 2, 'min_samples_leaf': 1, 'max_features': 'sqrt', 'max_depth': 30}The best model is a model with 100 trees, with a minimum number of samples per split of 2, a minimum number of samples per leaf of 1 and a maximum depth of 30.

We then fit a Random Forest using the best parameters found previous and compute evaluation metrics on the test set.

rf_best = RandomForestRegressor(**best_params, random_state=42)

rf_best.fit(training.drop(columns=['year', 'cpi','predicted_cpi','residuals']), training['cpi'])

# Predictions

train_preds = rf_best.predict(training.drop(columns=['year', 'cpi','predicted_cpi','residuals']))

test_preds = rf_best.predict(test.drop(columns=['year', 'cpi','predicted_cpi','residuals']))

# Compute Metrics

train_r2 = r2_score(training['cpi'], train_preds)

test_r2 = r2_score(test['cpi'], test_preds)

train_mae = mean_absolute_error(training['cpi'], train_preds)

test_mae = mean_absolute_error(test['cpi'], test_preds)

print(f"Training R²: {train_r2:.4f}, MAE: {train_mae:.4f}")

print(f"Test R²: {test_r2:.4f}, MAE: {test_mae:.4f}")Training R²: 0.9957, MAE: 0.6007

Test R²: -1.4810, MAE: 32.1640Again, the metrics show a pattern of severe overfitting: the model is learning the training data too well and can’t generalize to new data. It also points to the wide discrepancy in patterns between the training and test sets: the patterns before 1327 differ significantly from patterns after 1327 (we should most likely use a smaller train-test split gap or use a sliding window approach). Our data is highly non-stationary: the patterns before 1327 fit a relatively stable economic situation while the patterns after that date fit a gradually worsening political and economic crisis.

Diagnosing the model a bit further

Let’s dig into this model a bit further.

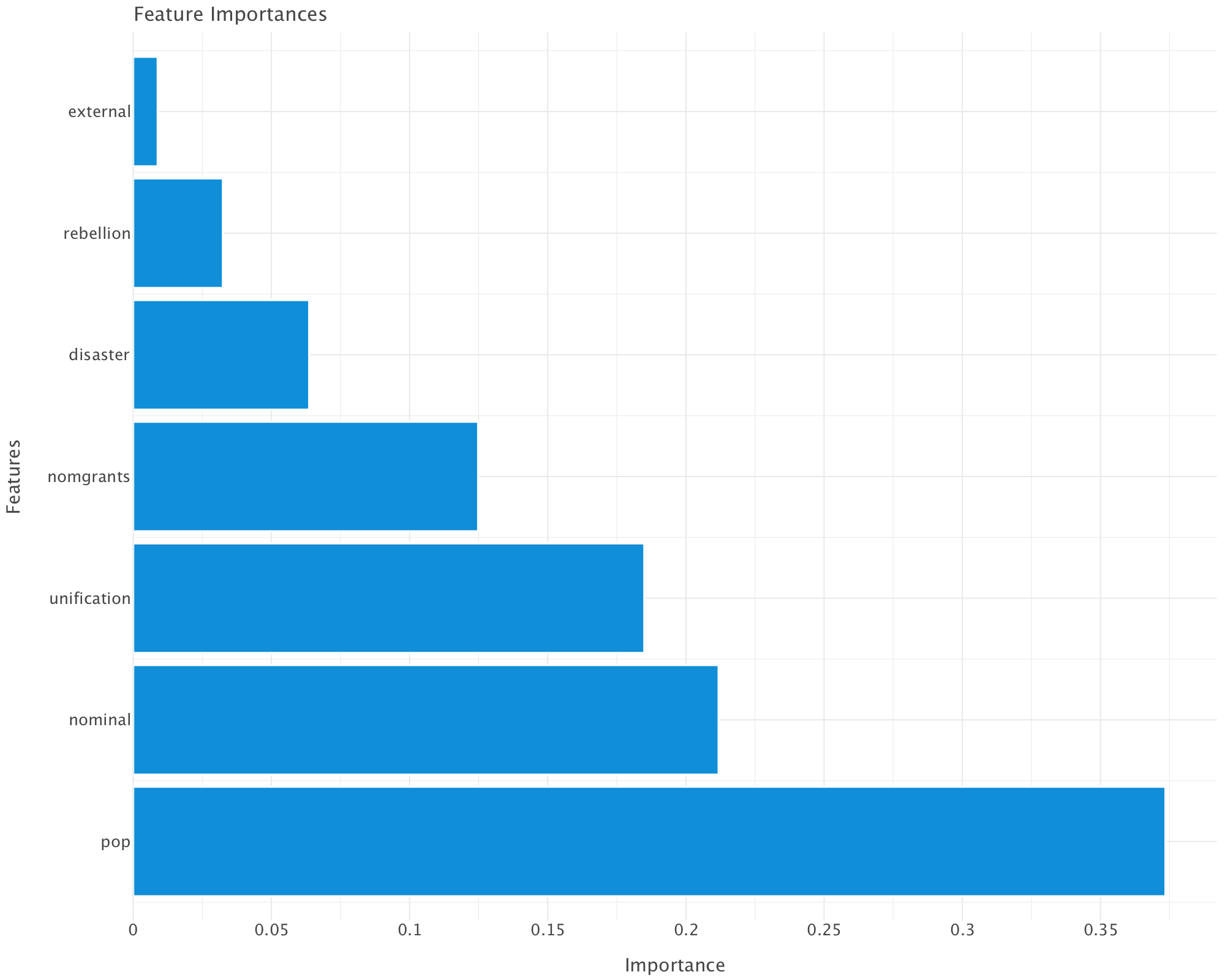

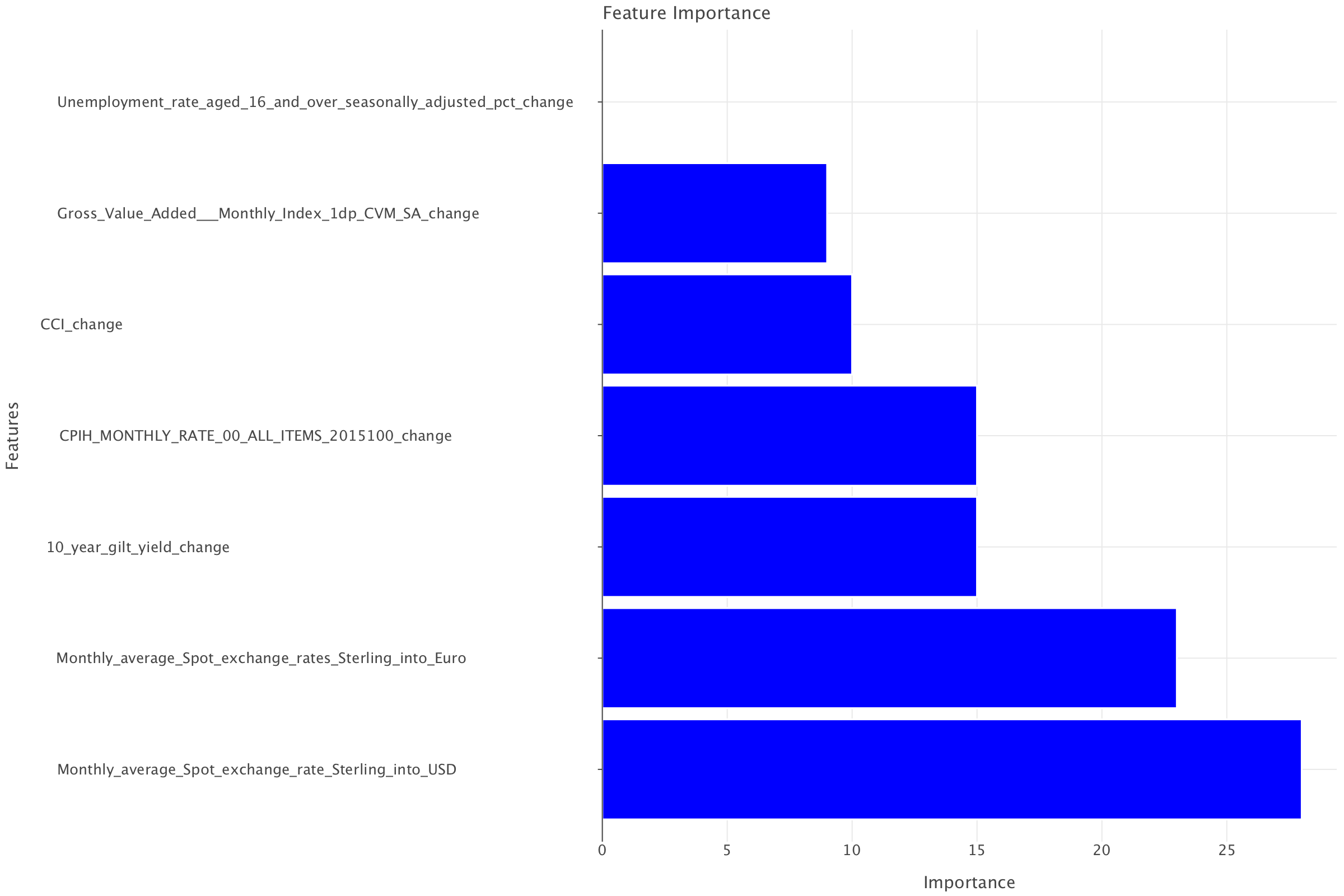

First, let’s have a look at feature importance for this model.

# Extract feature importances

importances = rf_best.feature_importances_

indices = np.argsort(importances)[::-1]

# Create dataframe for lets_plot

importance_df = pd.DataFrame({

'feature': [features[i] for i in indices],

'importance': importances[indices]

})

# Plot feature importances with lets_plot

importance_plot = (ggplot(importance_df)

+ geom_bar(aes(x='feature', y='importance'), stat='identity')

+ coord_flip()

+ ggtitle('Feature Importances')

+ xlab('Features')

+ ylab('Importance')

+ theme_minimal()

+ggsize(1000, 800))

importance_plot.show()

# Print feature importances

print("\nFeature Importances:")

for i in indices:

print(f"{features[i]}: {importances[i]:.4f}")

Feature Importances:

pop: 0.3735

nominal: 0.2118

unification: 0.1849

nomgrants: 0.1248

disaster: 0.0637

rebellion: 0.0324

external: 0.0088Interpretation of Feature Importances

👣 Population (pop) – 37.35% (Most Important)

This makes sense since CPI (Consumer Price Index) is heavily influenced by population dynamics.

A growing population can increase demand for goods, potentially driving up prices (inflation). Conversely, a population decline might reduce demand and stabilize or deflate prices.

💰 Nominal Money Issues (nominal) – 21.18%

Its high importance suggests a strong link between money supply and inflation. Large issuances of nominal money (possibly due to excessive printing or overuse of paper currency) could lead to devaluation of money, increasing CPI. This aligns with classical inflation theory (more money in circulation = higher prices).

⚔️ Unification Wars (unification) – 18.49%

War expenses, resource allocation, and territorial expansion could disrupt economies. Unification wars may have spurred economic policies that affected inflation, such as increased taxation or monetary expansion to fund conquests.

🎖️ Imperial Grants (nomgrants) – 12.48%

This suggests that imperial grants had an impact on inflation. Large grants might have increased monetary circulation, pushing CPI higher.

🌪️ Disasters (disaster) – 6.37%

Disasters can destroy resources, reduce agricultural output, and cause temporary supply shocks that affect prices. However, their importance is lower than expected, which suggests that other factors (like monetary policy and wars) had a stronger influence on CPI.

🛡️ Rebellions (rebellion) – 3.24%

Rebellions might have caused localized economic disturbances but may not have had a systemic impact on CPI across all years.

🌍 External Wars (external) – 0.88% (Least Important)

Their importance is surprisingly low, which suggests that foreign conflicts had little effect on internal price levels. This might indicate that the Yuan economy was not highly trade-dependent or that external wars didn’t disrupt domestic markets significantly.

What does this means for our model?

Our model suggests inflation (CPI) in Yuan China was primarily driven by domestic economic factors rather than external conflicts.

Government monetary policy (nominal money issues, grants) and population changes were key drivers.

Wars played a role, but unification wars had a bigger impact than external conflicts or rebellions.

Disasters had a moderate impact—perhaps because economic resilience or policy responses mitigated their effects.

⚠️ These findings are obviously to be taken with a pinch of salt given what we know of the patterns of overfitting of our model. To get a more accurate idea of what is going on, we could try and extract feature importance over expanding time windows.

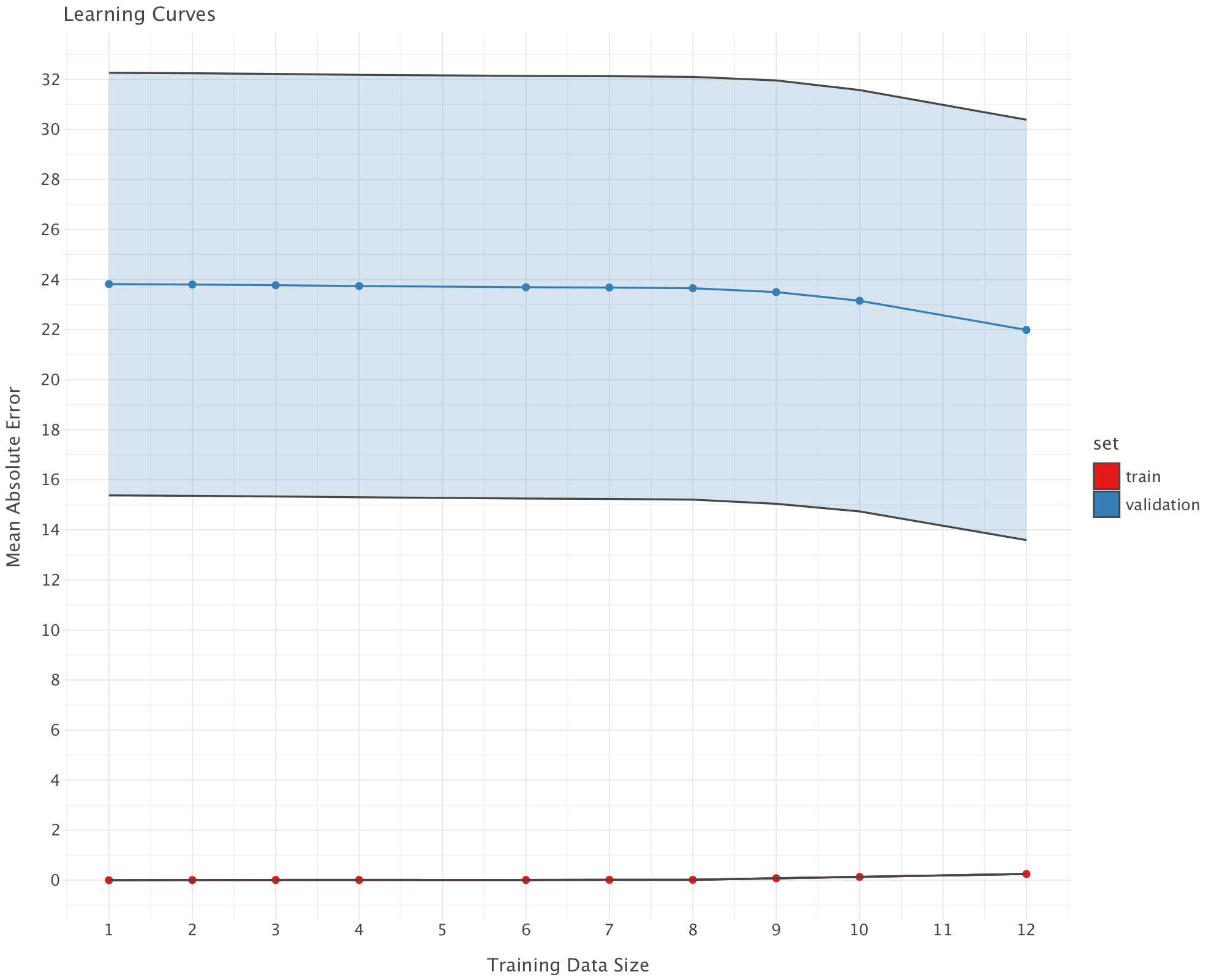

Now let’s look at learning curves. Learning curves show how model performance changes with increasing training data size, comparing training error (red) (i.e error on the set prior to 1327) with validation error (i.e error on the set from 1327 onwards) (blue).

# Generate learning curves

train_sizes, train_scores, val_scores = learning_curve(

rf_best,

training[features],

training['cpi'],

cv=tscv,

scoring='neg_mean_absolute_error',

train_sizes=np.linspace(0.1, 1.0, 10),

n_jobs=-1

)

# Calculate means and standard deviations

train_mean = -np.mean(train_scores, axis=1) # Convert back from negative

val_mean = -np.mean(val_scores, axis=1) # Convert back from negative

train_std = np.std(train_scores, axis=1)

val_std = np.std(val_scores, axis=1)

# Create dataframe for lets_plot

learning_df = pd.DataFrame({

'train_size': np.concatenate([train_sizes, train_sizes]),

'error': np.concatenate([train_mean, val_mean]),

'error_min': np.concatenate([train_mean - train_std, val_mean - val_std]),

'error_max': np.concatenate([train_mean + train_std, val_mean + val_std]),

'set': np.concatenate([['train']*len(train_sizes), ['validation']*len(train_sizes)])

})

# Plot learning curves with lets_plot

learning_plot = (ggplot(learning_df)

+ geom_line(aes(x='train_size', y='error', color='set'))

+ geom_point(aes(x='train_size', y='error', color='set'))

+ geom_ribbon(aes(x='train_size', ymin='error_min', ymax='error_max', fill='set'), alpha=0.2)

+ ggtitle('Learning Curves')

+ xlab('Training Data Size')

+ ylab('Mean Absolute Error')

+ theme_minimal()

+ggsize(1000, 800))

learning_plot.show()

Interpretation of the Learning Curve

Train Error (Red, near 0)

- The training error is extremely low (near 0), meaning the model perfectly fits the training data.

- This is a sign of overfitting—the model memorizes training data instead of generalizing.

Validation Error (Blue, high and stable)

The validation MAE is very high (~24+) and does not decrease significantly with more data.

This suggests that adding more training data does not improve generalization. This indicates either of the following:

- A modeling issue (Random Forest might not be the best choice).

- Feature issues (some predictors might be noisy or not informative enough).

- Data shift (training and validation sets might come from different distributions - this is very likely as the economic pattern prior to 1327 are wildly different from the patterns from 1327 onwards)

Gap Between Train and Validation Errors

A large gap between training and validation errors confirms overfitting. The model is too complex and does not generalize well.

In building this new model, we didn’t go any further than changing models and implementing time-aware cross-validation/hyperparameter tuning. We could obviously have done some feature engineering e.g including lagged variables, etc. We could also try and implement strategies that explicitly take into account the data shift after 1327!

Part 3

Question 1

Let’s load the rates data in df dataframe and the economic indicators data in an economic_indicators dataframe.

df = pd.read_csv('../../data/BoE_interest_rates.csv')

economic_indicators = pd.read_csv('../../data/economic_indicators_interest_rate_setting.csv')Let’s visualise the first lines of both dataframes before proceeding.

df.head()| Date | Rate | rate_change | |

|---|---|---|---|

| 0 | 1997-05-06 | 6.25 | 1 |

| 1 | 1997-06-06 | 6.50 | 1 |

| 2 | 1997-07-10 | 6.75 | 1 |

| 3 | 1997-08-07 | 7.00 | 1 |

| 4 | 1997-11-06 | 7.25 | 1 |

economic_indicators.head()| Date | CCI | Unemployment rate (aged 16 and over, seasonally adjusted): % | 10-year-gilt-yield | CPIH MONTHLY RATE 00: ALL ITEMS 2015=100 | Gross Value Added - Monthly (Index 1dp) :CVM SA | Monthly average Spot exchange rate, Sterling into US$ [a] XUMAGBD | Monthly average Spot exchange rates, Sterling into Euro [a] XUMASER | |

|---|---|---|---|---|---|---|---|---|

| 0 | 1997-01-01 | 102.2504 | 7.5 | 7.5552 | -0.3 | 62.0 | 0.6031 | 0.7376 |

| 1 | 1997-02-01 | 102.5327 | 7.3 | 7.1962 | 0.2 | 62.5 | 0.6156 | 0.7192 |

| 2 | 1997-03-01 | 102.6905 | 7.2 | 7.4544 | 0.2 | 62.6 | 0.6226 | 0.7172 |

| 3 | 1997-04-01 | 102.7900 | 7.2 | 7.6380 | 0.4 | 63.3 | 0.6137 | 0.7022 |

| 4 | 1997-05-01 | 102.9294 | 7.2 | 7.1681 | 0.4 | 62.7 | 0.6122 | 0.7034 |

We convert the Date column to datetime format in both dataframes and sort the dataframes by Date

df['Date'] = pd.to_datetime(df['Date'])

df = df.sort_values(by='Date')

economic_indicators['Date'] = pd.to_datetime(economic_indicators['Date'])

economic_indicators = economic_indicators.sort_values(by='Date')economic_indicators.tail()| Date | CCI | Unemployment rate (aged 16 and over, seasonally adjusted): % | 10-year-gilt-yield | CPIH MONTHLY RATE 00: ALL ITEMS 2015=100 | Gross Value Added - Monthly (Index 1dp) :CVM SA | Monthly average Spot exchange rate, Sterling into US$ [a] XUMAGBD | Monthly average Spot exchange rates, Sterling into Euro [a] XUMASER | |

|---|---|---|---|---|---|---|---|---|

| 330 | 2024-07-01 | 100.24810 | 4.1 | 4.1386 | 0.0 | 101.2 | 0.7775 | 0.8432 |

| 331 | 2024-08-01 | 100.00320 | 4.3 | 3.9444 | 0.4 | 101.3 | 0.7734 | 0.8518 |

| 332 | 2024-09-01 | 99.35313 | 4.3 | 3.9053 | 0.1 | 101.3 | 0.7566 | 0.8401 |

| 333 | 2024-10-01 | 99.03065 | 4.4 | 4.1993 | 0.6 | 101.1 | 0.7666 | 0.8353 |

| 334 | 2024-11-01 | 99.04012 | 4.4 | 4.4164 | 0.2 | 101.2 | 0.7844 | 0.8335 |

The last available economic indicators are in 01-11-2024. We need to make sure that we drop any row of df for which we don’t have matching economic indicators (i.e rates set beyond December 2024).

We drop rows from df that fall in months after the last available economic indicators.

# The last available date in economic_indicators

last_available_date = economic_indicators['Date'].max()

# Get the last day of the last available month (November 2024)

last_available_month_end = pd.to_datetime(f"{last_available_date.year}-{last_available_date.month:02d}-01") + pd.DateOffset(months=1) - pd.DateOffset(days=1)

# Filter out rows in df where the rate-setting date is beyond the end of the last available month (November 2024)

df = df[df['Date'] <= last_available_month_end]Let’s check that this worked.

df.tail()| Date | Rate | rate_change | |

|---|---|---|---|

| 62 | 2023-05-11 | 4.50 | 1 |

| 63 | 2023-06-22 | 5.00 | 1 |

| 64 | 2023-08-03 | 5.25 | 1 |

| 65 | 2024-08-01 | 5.00 | -1 |

| 66 | 2024-11-07 | 4.75 | -1 |

# Step 1: List of economic indicators to compute averages for (excluding 'Date')

indicators = [col for col in economic_indicators.columns if col != 'Date']

# Step 2: Create the date range for the previous 3 months (first of each month)

# For each rate-setting date, generate the first day of the last 3 months

df['Date_prev_3_months'] = [pd.date_range(end=row['Date'], periods=3, freq='MS') for _, row in df.iterrows()]

# Step 3: Preserve the original rate-setting date before exploding

df['Original_Date'] = df['Date']

# Step 4: Expand the 'Date_prev_3_months' column into separate rows (one for each month)

expanded_df = df.explode('Date_prev_3_months')

# Step 5: Merge the expanded DataFrame with economic indicators on 'Date_prev_3_months'

merged_df = pd.merge(expanded_df, economic_indicators, left_on='Date_prev_3_months', right_on='Date', how='left')

# Step 6: Drop the redundant 'Date_y' column from the merge, as it duplicates 'Date'

merged_df.drop(columns=['Date_y'], inplace=True)

# Step 7: Group by 'Original_Date' and calculate the mean for each indicator over the previous 3 months

averages_df = merged_df.groupby('Original_Date')[indicators].mean()

# Step 8: Merge the averages back into the original df (df will now include rolling averages for the indicators)

df = pd.merge(df, averages_df, left_on='Original_Date', right_index=True, how='left')

# Step 9: Drop temporary columns used for merging (these are no longer needed)

df.drop(columns=['Date_prev_3_months', 'Original_Date'], inplace=True)

# Step 10: Display the final df with averages

print("Final df with averages:")

df.head()Final df with averages:| Date | Rate | rate_change | CCI | Unemployment rate (aged 16 and over, seasonally adjusted): % | 10-year-gilt-yield | CPIH MONTHLY RATE 00: ALL ITEMS 2015=100 | Gross Value Added - Monthly (Index 1dp) :CVM SA | Monthly average Spot exchange rate, Sterling into US$ [a] XUMAGBD | Monthly average Spot exchange rates, Sterling into Euro [a] XUMASER | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 1997-05-06 | 6.25 | 1 | 102.803300 | 7.200000 | 7.420167 | 0.333333 | 62.866667 | 0.616167 | 0.707600 |

| 1 | 1997-06-06 | 6.50 | 1 | 102.885733 | 7.233333 | 7.315967 | 0.333333 | 63.000000 | 0.611333 | 0.698467 |

| 2 | 1997-07-10 | 6.75 | 1 | 102.910667 | 7.200000 | 7.122533 | 0.133333 | 63.033333 | 0.606367 | 0.683067 |

| 3 | 1997-08-07 | 7.00 | 1 | 102.891300 | 7.066667 | 7.096267 | 0.133333 | 63.266667 | 0.610233 | 0.670233 |

| 4 | 1997-11-06 | 7.25 | 1 | 102.958967 | 6.600000 | 6.652167 | 0.133333 | 63.933333 | 0.609667 | 0.679933 |

Step 1: List of Economic Indicators

indicators = [col for col in economic_indicators.columns if col != 'Date']- Purpose: This creates a list of column names (

indicators) fromeconomic_indicators, excluding the columnDate. This is important because we only want to compute averages for the economic indicators, not for theDatecolumn.

Step 2: Create the Date Range for the Previous 3 Months

df['Date_prev_3_months'] = [pd.date_range(end=row['Date'], periods=3, freq='MS') for _, row in df.iterrows()]- Purpose: This step creates a new column

Date_prev_3_monthsin thedfDataFrame.- For each row in

df, it generates a range of dates representing the first day of the last 3 months, based on theDatecolumn. pd.date_range(end=row['Date'], periods=3, freq='MS')generates a range of 3 dates, starting from the first day of the month (MSstands for “Month Start”) and going backwards in time from the date in theDatecolumn.

- For each row in

Example: If Date is “1997-05-06”, the result will be a range of dates: ['1997-05-01', '1997-04-01', '1997-03-01'].

Step 3: Preserve the Original Rate-Setting Date

df['Original_Date'] = df['Date']- Purpose: This saves a copy of the

Datecolumn in a new column calledOriginal_Date. This is important because we will modify theDatecolumn (by exploding theDate_prev_3_monthscolumn), and we still need access to the originalDatefor later calculations.

Step 4: Expand the ‘Date_prev_3_months’ Column into Separate Rows

expanded_df = df.explode('Date_prev_3_months')- Purpose: The

explode()function transforms each row indfthat has a list (such as the list of 3 months in theDate_prev_3_monthscolumn) into multiple rows. - After exploding, for each row in the original

df, we now have 3 rows—one for each of the months inDate_prev_3_months.

Example: If a row has Date_prev_3_months = ['1997-05-01', '1997-04-01', '1997-03-01'], it will be transformed into 3 rows, each with one of those dates.

Step 5: Merge the Expanded DataFrame with Economic Indicators

merged_df = pd.merge(expanded_df, economic_indicators, left_on='Date_prev_3_months', right_on='Date', how='left')- Purpose: This merges the exploded DataFrame (

expanded_df) with theeconomic_indicatorsDataFrame on the columnsDate_prev_3_months(fromexpanded_df) andDate(fromeconomic_indicators). - The

how='left'argument ensures that all rows fromexpanded_dfare kept, even if there is no corresponding match ineconomic_indicators. Missing values fromeconomic_indicatorswill be filled withNaN.

Step 6: Drop the Redundant ‘Date_y’ Column

merged_df.drop(columns=['Date_y'], inplace=True)- Purpose: After merging,

pandasautomatically adds suffixes to columns that have the same name (in this case,Date). It adds_xfor columns fromexpanded_dfand_yfor columns fromeconomic_indicators. Since we are interested in theDatefromexpanded_df(theDate_prev_3_months), we drop the redundantDate_ycolumn.

Step 7: Group by ‘Original_Date’ and Calculate the Mean for Each Indicator

averages_df = merged_df.groupby('Original_Date')[indicators].mean()- Purpose: This groups the merged DataFrame by

Original_Date(the originalDatecolumn we preserved). - Then, for each group (i.e., for each unique

Original_Date), it calculates the mean of the economic indicators (indicatorslist).- The

groupby()function splits the data into groups based onOriginal_Date, and then the.mean()function computes the average of all the numerical columns in theindicatorslist for each group.

- The

Result: The averages_df will contain one row per Original_Date and columns for the mean values of each indicator over the last 3 months.

Step 8: Merge the Averages Back into the Original DataFrame

df = pd.merge(df, averages_df, left_on='Original_Date', right_index=True, how='left')- Purpose: This merges the

averages_dfDataFrame (containing the rolling averages for each indicator) back into the originaldfDataFrame. - It matches rows on the

Original_Datecolumn indfwith the index inaverages_df(which is alsoOriginal_Dateafter thegroupby). - The result is that

dfnow contains the original columns along with the calculated averages for each indicator.

Step 9: Drop Temporary Columns Used for Merging

df.drop(columns=['Date_prev_3_months', 'Original_Date'], inplace=True)- Purpose: After merging the rolling averages, we no longer need the temporary columns

Date_prev_3_monthsandOriginal_Datethat were used for merging and intermediate processing. This step removes those columns.

Step 10: Display the Final DataFrame

print("Final df with averages:")

df.head()- Purpose: Finally, this displays the first few rows of the modified

df, which now includes the rolling averages for each indicator.

Summary:

- The code calculates rolling averages for each economic indicator over the previous 3 months for each rate-setting date (

Dateindf). - It works by creating a list of the first days of the previous 3 months, exploding the data to create multiple rows per date, merging with the economic indicators, and calculating the average for each date.

- The final DataFrame contains the original data with additional columns for the rolling averages of each economic indicator.

Let’s check the result of our processing

df.head()| Date | Rate | rate_change | CCI | Unemployment rate (aged 16 and over, seasonally adjusted): % | 10-year-gilt-yield | CPIH MONTHLY RATE 00: ALL ITEMS 2015=100 | Gross Value Added - Monthly (Index 1dp) :CVM SA | Monthly average Spot exchange rate, Sterling into US$ [a] XUMAGBD | Monthly average Spot exchange rates, Sterling into Euro [a] XUMASER | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 1997-05-06 | 6.25 | 1 | 102.803300 | 7.200000 | 7.420167 | 0.333333 | 62.866667 | 0.616167 | 0.707600 |

| 1 | 1997-06-06 | 6.50 | 1 | 102.885733 | 7.233333 | 7.315967 | 0.333333 | 63.000000 | 0.611333 | 0.698467 |

| 2 | 1997-07-10 | 6.75 | 1 | 102.910667 | 7.200000 | 7.122533 | 0.133333 | 63.033333 | 0.606367 | 0.683067 |

| 3 | 1997-08-07 | 7.00 | 1 | 102.891300 | 7.066667 | 7.096267 | 0.133333 | 63.266667 | 0.610233 | 0.670233 |

| 4 | 1997-11-06 | 7.25 | 1 | 102.958967 | 6.600000 | 6.652167 | 0.133333 | 63.933333 | 0.609667 | 0.679933 |

Let’s look at the current data

report = sv.analyze(df)

report.show_notebook()This is a small dataset: only 67 observations, with 8 features (excluding date). There is also a large gap in the data: no rate setting data is available between 05-03-2009 and 04-08-2016, which is a period where rates remained stable at 0.5%.

Question 2

Let’s split our data into training and test set.

# Step 1: Ensure the DataFrame is sorted by Date (if not already sorted)

df = df.sort_values(by='Date')

# Step 2: Determine the split index (70% training, 30% test)

split_index = int(len(df) * 0.7)

# Step 3: Split into training and test sets

train_df = df.iloc[:split_index] # First 70% for training

test_df = df.iloc[split_index:] # Remaining 30% for testing

# Display the split results

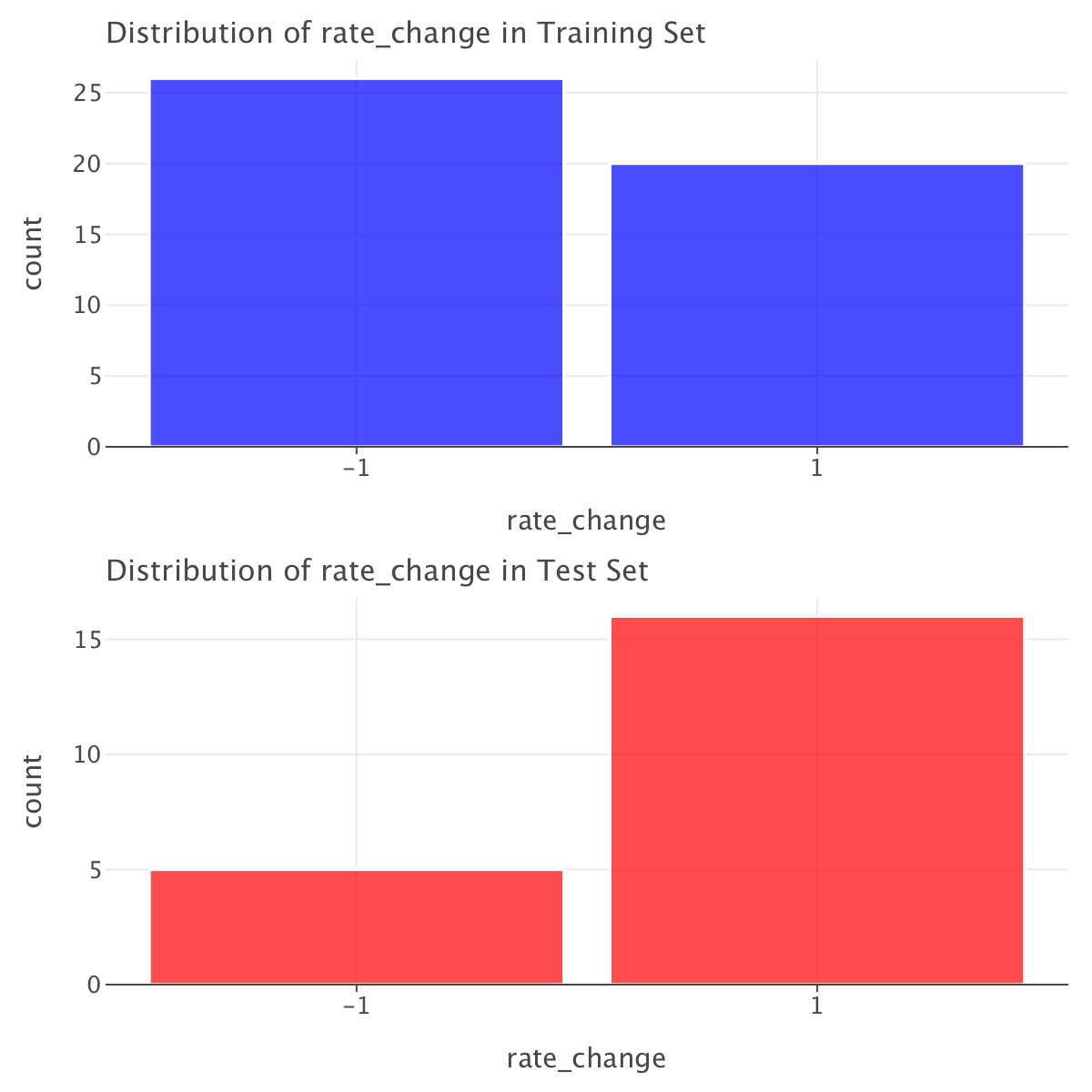

print(f"Training set size: {len(train_df)}, Test set size: {len(test_df)}")Training set size: 46, Test set size: 21Let’s check the distribution of the target variable rate_change in both training and test sets

# Check distribution of rate_change in the training set

train_distribution = train_df['rate_change'].value_counts(normalize=True)

# Check distribution of rate_change in the test set

test_distribution = test_df['rate_change'].value_counts(normalize=True)

# Display the proportions

print("Proportion of rate_change values in Training Set:\n", train_distribution)

print("\nProportion of rate_change values in Test Set:\n", test_distribution)Proportion of rate_change values in Training Set:

rate_change

-1 0.565217

1 0.434783

Name: proportion, dtype: float64

Proportion of rate_change values in Test Set:

rate_change

1 0.761905

-1 0.238095

Name: proportion, dtype: float64# Convert distributions to DataFrame for plotting

train_df_plot = pd.DataFrame({'rate_change': train_df['rate_change']})

test_df_plot = pd.DataFrame({'rate_change': test_df['rate_change']})

# Create bar plots

train_plot = ggplot(train_df_plot, aes(x='rate_change')) + \

geom_bar(fill='blue', alpha=0.7) + \

scale_x_continuous(breaks=[-1, 1]) + \

ggtitle("Distribution of rate_change in Training Set")

test_plot = ggplot(test_df_plot, aes(x='rate_change')) + \

geom_bar(fill='red', alpha=0.7) + \

scale_x_continuous(breaks=[-1, 1]) + \

ggtitle("Distribution of rate_change in Test Set")

# Display plots

gggrid([train_plot,test_plot],ncol=1)

The rate_change distribution is quite different between the training and test sets (on top of the fact that in both sets we have more samples of one class than another). The training set has 56.5% of -1 and 43.5% of 1, while the test set has 76.2% of 1 and only 23.8% of -1.

This suggests that the test set is not representative of the overall distribution, which could lead to biased model performance. One way of dealing with that is to use class weights while training our models.

Now that we now where things stand, let’s create a baseline logistic regression model for this dataset. Since there is class imbalance within both training and test sets and since the distribution of rate_change looks quite different between both training and test sets, we’ll train this model with class weights. We’ll build a model with all features (except Date).

# Select features (excluding 'rate_change' which is the target)

X_train = train_df.drop(columns=['rate_change','Rate', 'Date']) # Drop 'Date' if not needed

y_train = train_df['rate_change']

X_test = test_df.drop(columns=['rate_change', 'Date','Rate'])

y_test = test_df['rate_change']

# Standardize features (Logistic Regression is sensitive to scale)

scaler = StandardScaler()

X_train_scaled = scaler.fit_transform(X_train)

X_test_scaled = scaler.transform(X_test)

# Train logistic regression with class weights

model = LogisticRegression(class_weight='balanced', random_state=42)

model.fit(X_train_scaled, y_train)

# Make predictions

y_pred = model.predict(X_test_scaled)

y_pred_train= model.predict(X_train_scaled)Let’s compute metrics for both training and test sets.

# Compute metrics

precision = precision_score(y_test, y_pred,zero_division=np.nan)

precision_train = precision_score(y_train, y_pred_train,zero_division=np.nan)

recall = recall_score(y_test, y_pred)

recall_train = recall_score(y_train, y_pred_train)

f1 = f1_score(y_test, y_pred)

f1_train = f1_score(y_train, y_pred_train)

balanced_acc = balanced_accuracy_score(y_test, y_pred)

balanced_acc_train = balanced_accuracy_score(y_train, y_pred_train)

# Get predicted probabilities for AUC calculation

y_prob = model.predict_proba(X_test_scaled)[:, 1] # Probabilities for class 1

y_prob_train = model.predict_proba(X_train_scaled)[:, 1] # Probabilities for class 1 (training set)

roc_auc = roc_auc_score(y_test, y_prob)

roc_auc_train = roc_auc_score(y_train, y_prob_train)

pr_auc = average_precision_score(y_test, y_prob)

pr_auc_train = average_precision_score(y_train, y_prob_train)

# Display metrics

metrics_df = pd.DataFrame({

"Metric": ["Precision", "Recall", "F1 Score", "Balanced Accuracy", "ROC-AUC", "PR-AUC"],

"Training": [precision_train, recall_train, f1_train, balanced_acc_train, roc_auc_train, pr_auc_train],

"Test": [precision, recall, f1, balanced_acc, roc_auc, pr_auc]

})

print(metrics_df)Metric Training Test

0 Precision 0.904762 NaN

1 Recall 0.950000 0.000000

2 F1 Score 0.926829 0.000000

3 Balanced Accuracy 0.936538 0.500000

4 ROC-AUC 0.980769 0.425000

5 PR-AUC 0.972312 0.739026# Confusion Matrix for the training set

conf_matrix_train = confusion_matrix(y_train, y_pred_train)

# Extract TP, FP, FN, TN from confusion matrix

TN_train, FP_train, FN_train, TP_train = conf_matrix_train.ravel()

# Print the counts

print(f"True Negatives (TN): {TN_train}")

print(f"False Positives (FP): {FP_train}")

print(f"False Negatives (FN): {FN_train}")

print(f"True Positives (TP): {TP_train}")

# Convert confusion matrix to a DataFrame

conf_matrix_df_train = pd.DataFrame(

conf_matrix_train,

columns=["Predicted -1", "Predicted 1"],

index=["Actual -1", "Actual 1"]

)

# Melt the confusion matrix DataFrame to long format

conf_matrix_long_train = conf_matrix_df_train.reset_index().melt(id_vars="index", value_vars=["Predicted -1", "Predicted 1"])

conf_matrix_long_train.columns = ["Actual", "Predicted", "Count"]

# Define a mapping of coordinates to labels

label_map = {

("Actual -1", "Predicted -1"): "TN",

("Actual -1", "Predicted 1"): "FP",

("Actual 1", "Predicted -1"): "FN",

("Actual 1", "Predicted 1"): "TP",

}

# Add annotations for TP, FP, FN, TN counts

conf_matrix_long_train['Annotation'] = conf_matrix_long_train.apply(

lambda row: f"{label_map[(row['Actual'], row['Predicted'])]}: {row['Count']}", axis=1

)

# Create confusion matrix plot with Lets-Plot

conf_matrix_plot_train = ggplot(conf_matrix_long_train, aes(x='Predicted', y='Actual', fill='Count')) + \

geom_tile() + \

geom_text(aes(label='Annotation'), size=10, color='black', vjust=0.5, hjust=0.5) + \

scale_fill_gradient(low='white', high='blue') + \

ggtitle('Confusion Matrix (training set)') + \

xlab('Predicted') + \

ylab('Actual') + \

coord_fixed(ratio=1) + \

theme_minimal() + \

theme(

legend_position='right',

plot_margin=0 # FIX: Remove element_blank() and use 0

)

# Confusion Matrix for the training set

conf_matrix_test = confusion_matrix(y_test, y_pred)

# Extract TP, FP, FN, TN from confusion matrix

TN_test, FP_test, FN_test, TP_test = conf_matrix_test.ravel()

# Print the counts

print(f"True Negatives (TN) (Test): {TN_test}")

print(f"False Positives (FP) (Test): {FP_test}")

print(f"False Negatives (FN) (Test): {FN_test}")

print(f"True Positives (TP) (Test): {TP_test}")

# Convert confusion matrix to a DataFrame

conf_matrix_df_test = pd.DataFrame(

conf_matrix_test,

columns=["Predicted -1", "Predicted 1"],

index=["Actual -1", "Actual 1"]

)

# Melt the confusion matrix DataFrame to long format

conf_matrix_long_test = conf_matrix_df_test.reset_index().melt(id_vars="index", value_vars=["Predicted -1", "Predicted 1"])

conf_matrix_long_test.columns = ["Actual", "Predicted", "Count"]

# Define a mapping of coordinates to labels

label_map = {

("Actual -1", "Predicted -1"): "TN",

("Actual -1", "Predicted 1"): "FP",

("Actual 1", "Predicted -1"): "FN",

("Actual 1", "Predicted 1"): "TP",

}

# Add annotations for TP, FP, FN, TN counts

conf_matrix_long_test['Annotation'] = conf_matrix_long_test.apply(

lambda row: f"{label_map[(row['Actual'], row['Predicted'])]}: {row['Count']}", axis=1

)

# Create confusion matrix plot with Lets-Plot

conf_matrix_plot_test = ggplot(conf_matrix_long_test, aes(x='Predicted', y='Actual', fill='Count')) + \

geom_tile() + \

geom_text(aes(label='Annotation'), size=10, color='black', vjust=0.5, hjust=0.5) + \

scale_fill_gradient(low='white', high='blue') + \

ggtitle('Confusion Matrix (test set)') + \

xlab('Predicted') + \

ylab('Actual') + \

coord_fixed(ratio=1) + \

theme_minimal() + \

theme(

legend_position='right',

plot_margin=0 # FIX: Remove element_blank() and use 0

)

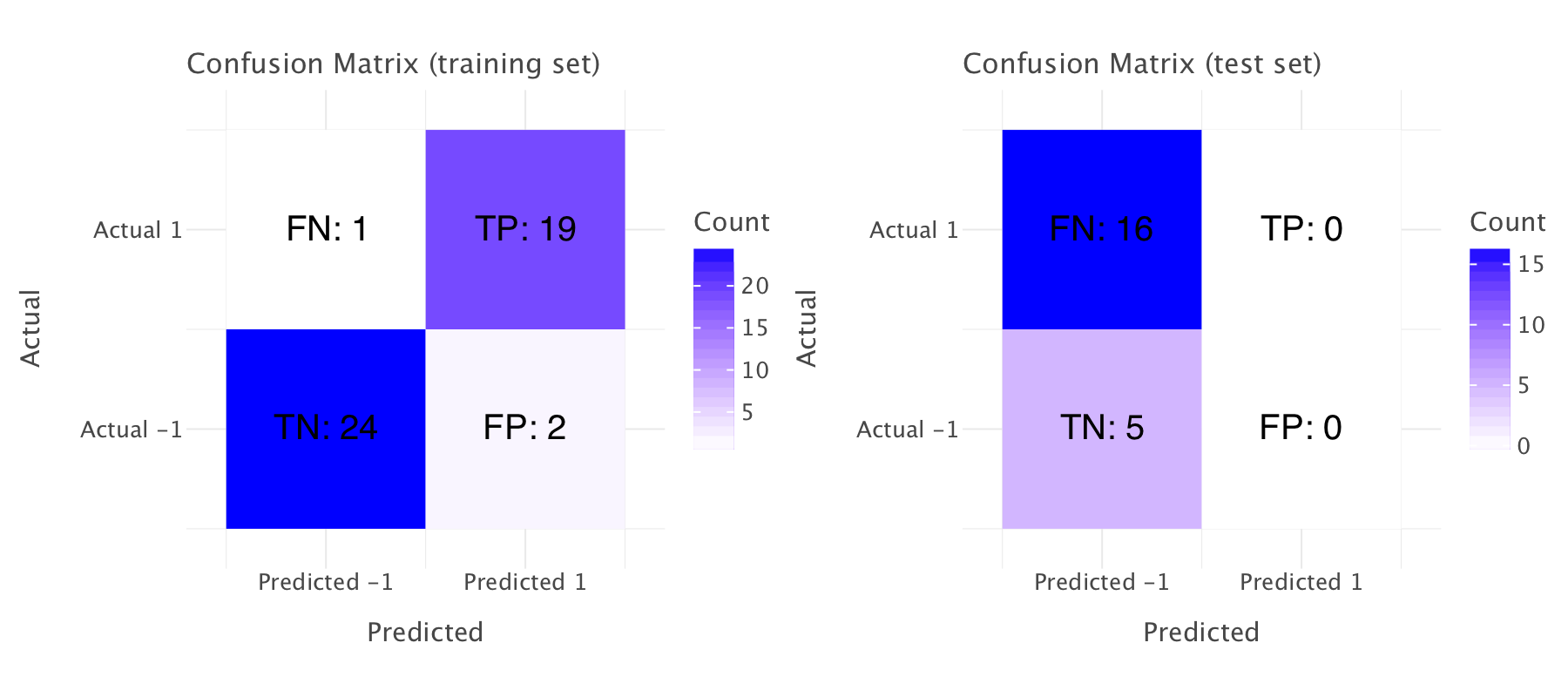

gggrid([conf_matrix_plot_train,conf_matrix_plot_test],ncol=2)True Negatives (TN): 24

False Positives (FP): 2

False Negatives (FN): 1

True Positives (TP): 19

True Negatives (TN) (Test): 5

False Positives (FP) (Test): 0

False Negatives (FN) (Test): 16

True Positives (TP) (Test): 0

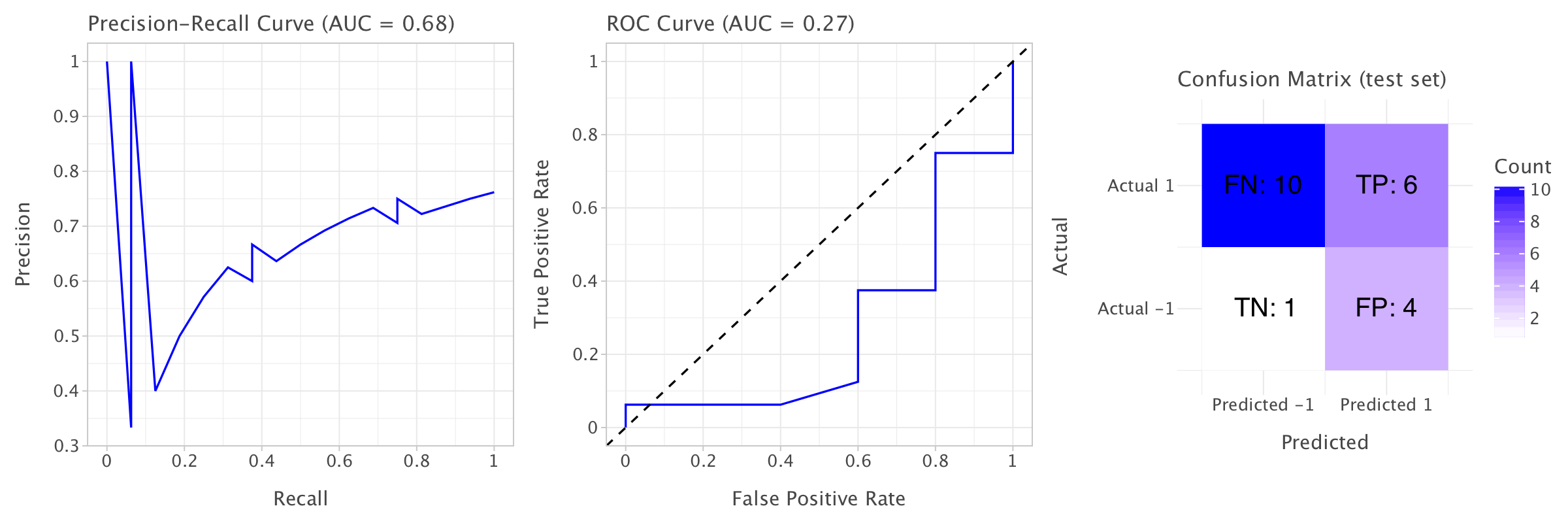

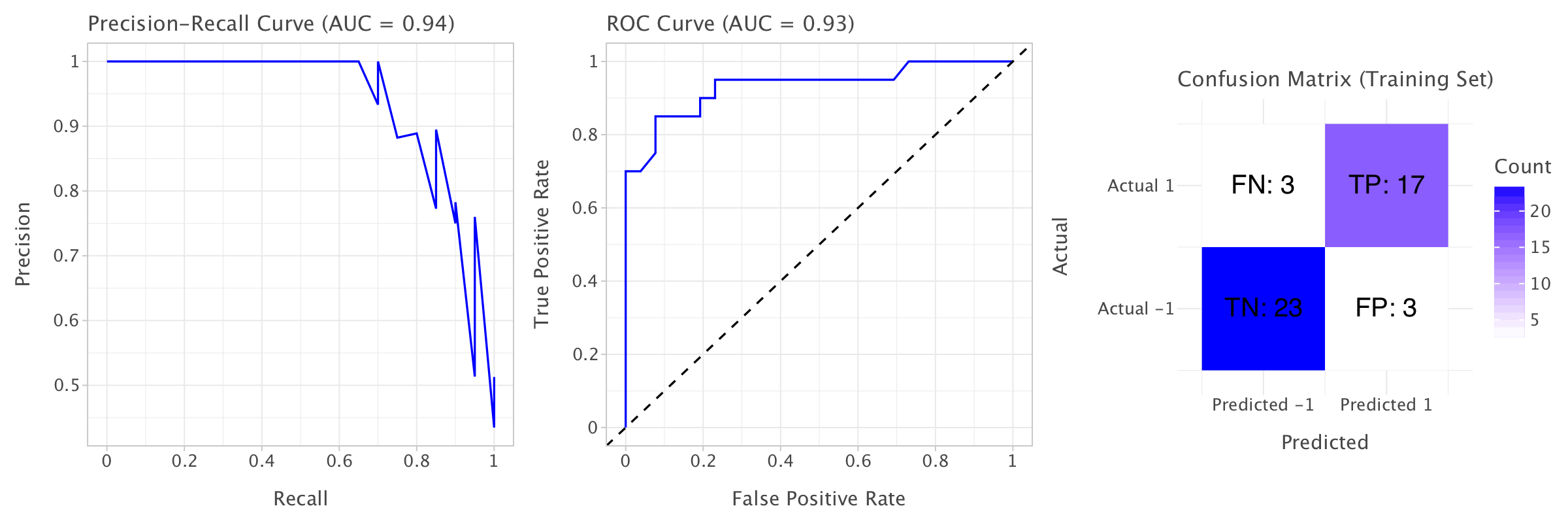

How can we interpret these metrics?

Training Set:

- Precision (0.9047): This suggests that when the model predicts a positive class (

rate change = 1), around 90.47% of the time, it is correct. - Recall (0.95): The model is correctly identifying 95% of the actual positive class (

rate change = 1). - F1 Score (0.9268): This is the harmonic mean of precision and recall. A score of 92.68% indicates a good balance between precision and recall.

- Balanced Accuracy (0.9365): This is a robust measure of accuracy when the dataset is imbalanced. 93.65% means the model is performing quite well, accounting for both classes.

- ROC-AUC (0.9846): A high value close to 1 suggests that the model is doing a great job distinguishing between classes (positive vs. negative).

- PR-AUC (0.9781): This is also high, meaning that the model is good at predicting positive instances, even in an imbalanced dataset.

Test Set:

- Precision (NaN): The NaN value for precision suggests that there might be no positive predictions at all from the model on the test set. This could mean that the model is predicting only the negative class for all test instances.

- Recall (0.0000): The zero recall implies that the model failed to identify any true positive instances from the test set, further supporting the idea that it isn’t predicting the positive class.

- F1 Score (0.0000): As a result of zero recall, the F1 score is also zero, as it depends on both precision and recall. No positive class predictions lead to no meaningful F1 score.

- Balanced Accuracy (0.5000): A balanced accuracy of 50% suggests that the model is performing no better than random guessing in terms of correctly predicting both classes.

- ROC-AUC (0.3500): The ROC-AUC value is quite low. A score of 0.35 indicates poor discrimination between classes in the test set, likely due to the lack of positive predictions.

- PR-AUC (0.6854): The PR-AUC is more favorable than the ROC-AUC, but still not great. However, this is likely skewed by the fact that there are no positive predictions, leading to an overall low score.

The confusion matrices confirm our observations on both training and test sets.

Key Takeaways:

- Training Set: The model performs well on the training set with high precision, recall, and F1 scores. The model shows strong discrimination capabilities (ROC-AUC and PR-AUC) and a solid balanced accuracy.

- Test Set: The model appears to be overfitting the training set, as it’s failing to generalize well to the test set. The NaN precision and zero recall indicate that the model is predicting only negative classes (

rate change = -1) on the test set, which can occur if the model is biased toward the negative class, especially in imbalanced datasets. The ROC-AUC and PR-AUC being low suggests that the model is not effectively distinguishing between the classes on the test data.

Possible Causes:

Our data is highly imbalanced in training and test sets, and the distribution of classes differs widely between training and test sets, which might explain this performance: training with class weights was not enough to address this.

We might also want to check for potential data leakage in the data and ensure that the data in the training and test sets are truly independent (i.e., the test data is not seen during training).

And again, just like in the Yuan dataset, the issues here point to a potential data shift between training and test sets: the monetary policy likely changed significantly in the period covered by the training set (i.e., from 06-05-1997 to 05-03-2009) and the period covered by the test set (04-08-2016 and 07-11-2024) 1.

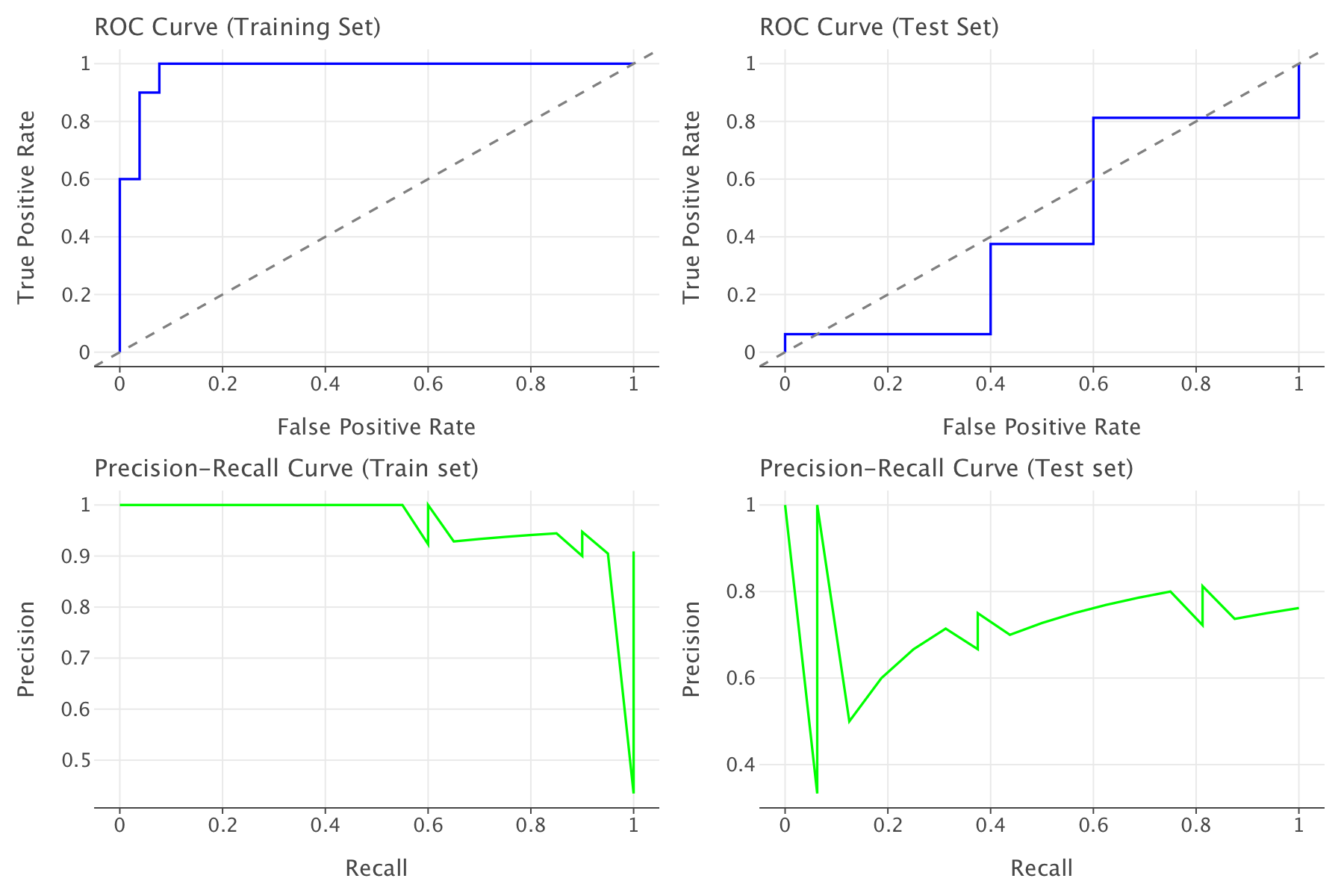

Finding an optimal classification threshold for logistic regression

We plot the ROC and precision-recall curves for this model and try to set an optimal classification threshold for it (we previously used the default 0.5 threshold).

# Compute ROC and PR curve values

fpr, tpr, _ = roc_curve(y_test, y_prob)

precisions, recalls, _ = precision_recall_curve(y_test, y_prob)

# Convert to DataFrames for plotting

roc_df = pd.DataFrame({'False Positive Rate': fpr, 'True Positive Rate': tpr})

pr_df = pd.DataFrame({'Recall': recalls, 'Precision': precisions})

# ROC Curve

roc_plot = ggplot(roc_df, aes(x='False Positive Rate', y='True Positive Rate')) + \

geom_line(color='blue') + \

ggtitle('ROC Curve (Test Set)') + \

geom_abline(slope=1, intercept=0, linetype="dashed", color="grey")

# PR Curve

pr_plot = ggplot(pr_df, aes(x='Recall', y='Precision')) + \

geom_line(color='green') + \

ggtitle('Precision-Recall Curve (Test set)')

fpr_train, tpr_train, _ = roc_curve(y_train, y_prob_train)

precisions_train, recalls_train, _ = precision_recall_curve(y_train, y_prob_train)

# Convert to DataFrames for plotting

roc_df_train = pd.DataFrame({'False Positive Rate': fpr_train, 'True Positive Rate': tpr_train})

pr_df_train = pd.DataFrame({'Recall': recalls_train, 'Precision': precisions_train})

# ROC Curve

roc_plot_train = ggplot(roc_df_train, aes(x='False Positive Rate', y='True Positive Rate')) + \

geom_line(color='blue') + \

ggtitle('ROC Curve (Training Set)') + \

geom_abline(slope=1, intercept=0, linetype="dashed", color="grey")

# PR Curve

pr_plot_train = ggplot(pr_df_train, aes(x='Recall', y='Precision')) + \

geom_line(color='green') + \

ggtitle('Precision-Recall Curve (Train set)')

g=gggrid([roc_plot_train,roc_plot,pr_plot_train,pr_plot],ncol=2)

g.show()

# Convert y_test to binary format (map -1 to 0)

y_test_binary = (y_test == 1).astype(int)

y_train_binary = (y_train == 1).astype(int)

# Get precision, recall, and thresholds

precision, recall, thresholds = precision_recall_curve(y_test_binary, y_prob)

# Compute F1-score for each threshold

f1_scores = (2 * precision * recall) / (precision + recall + 1e-9) # Avoid division by zero

# Find the best threshold (maximum F1-score)

best_threshold = thresholds[np.argmax(f1_scores)]

print(f"Optimal classification threshold: {best_threshold:.3f}")

# Apply the best threshold to make new predictions

y_pred_optimized = (y_prob > best_threshold).astype(int)

y_pred_optimized_train = (y_prob_train > best_threshold).astype(int)

# Compute new evaluation metrics using y_test_binary

precision_opt = precision_score(y_test_binary, y_pred_optimized)

recall_opt = recall_score(y_test_binary, y_pred_optimized)

f1_opt = f1_score(y_test_binary, y_pred_optimized)

balanced_acc_opt = balanced_accuracy_score(y_test_binary, y_pred_optimized)

# Compute new evaluation metrics using y_test_binary

precision_opt_train = precision_score(y_train_binary, y_pred_optimized_train)

recall_opt_train = recall_score(y_train_binary, y_pred_optimized_train)

f1_opt_train = f1_score(y_train_binary, y_pred_optimized_train)

balanced_acc_opt_train = balanced_accuracy_score(y_train_binary, y_pred_optimized_train)

# Display metrics

metrics_df = pd.DataFrame({

"Metric": ["Precision", "Recall", "F1 Score", "Balanced Accuracy"],

"Training": [precision_opt_train, recall_opt_train, f1_opt_train, balanced_acc_opt_train],

"Test": [precision_opt, recall_opt, f1_opt, balanced_acc_opt]

})

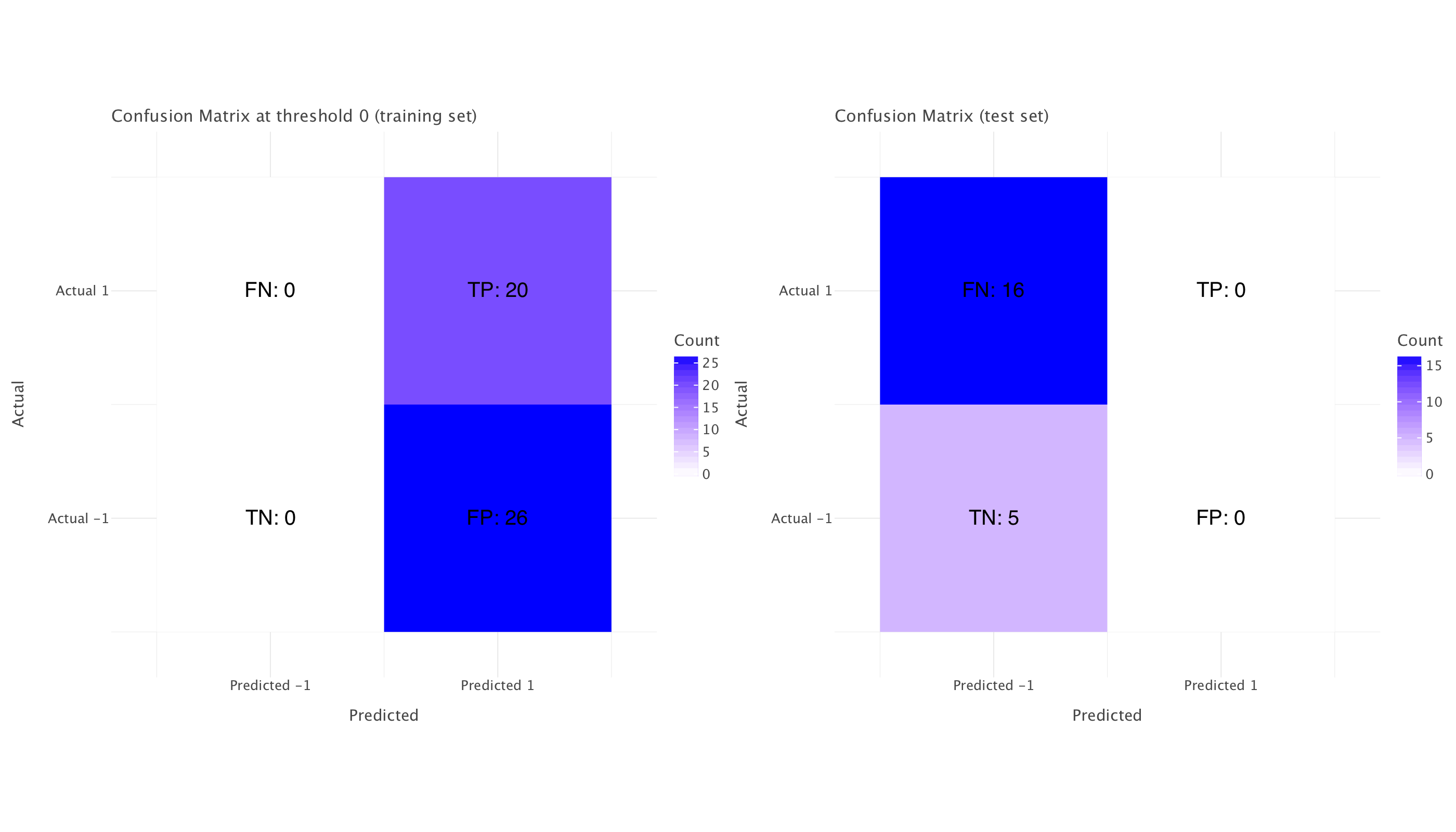

print(metrics_df)Optimal classification threshold: 0.000

Metric Training Test

0 Precision 0.434783 0.750000

1 Recall 1.000000 0.937500

2 F1 Score 0.606061 0.833333

3 Balanced Accuracy 0.500000 0.468750# Confusion Matrix for the training set

conf_matrix_train_opt = confusion_matrix(y_train_binary, y_pred_optimized_train)

# Extract TP, FP, FN, TN from confusion matrix

TN_train, FP_train, FN_train, TP_train = conf_matrix_train_opt.ravel()

# Print the counts

print(f"True Negatives (TN): {TN_train}")

print(f"False Positives (FP): {FP_train}")

print(f"False Negatives (FN): {FN_train}")

print(f"True Positives (TP): {TP_train}")

# Convert confusion matrix to a DataFrame

conf_matrix_df_train_opt = pd.DataFrame(

conf_matrix_train_opt,

columns=["Predicted -1", "Predicted 1"],

index=["Actual -1", "Actual 1"]

)

# Melt the confusion matrix DataFrame to long format

conf_matrix_long_train_opt = conf_matrix_df_train_opt.reset_index().melt(id_vars="index", value_vars=["Predicted -1", "Predicted 1"])

conf_matrix_long_train_opt.columns = ["Actual", "Predicted", "Count"]

# Define a mapping of coordinates to labels

label_map = {

("Actual -1", "Predicted -1"): "TN",

("Actual -1", "Predicted 1"): "FP",

("Actual 1", "Predicted -1"): "FN",

("Actual 1", "Predicted 1"): "TP",

}

# Add annotations for TP, FP, FN, TN counts

conf_matrix_long_train_opt['Annotation'] = conf_matrix_long_train_opt.apply(

lambda row: f"{label_map[(row['Actual'], row['Predicted'])]}: {row['Count']}", axis=1

)

# Create confusion matrix plot with Lets-Plot

conf_matrix_plot_train_opt = ggplot(conf_matrix_long_train_opt, aes(x='Predicted', y='Actual', fill='Count')) + \

geom_tile() + \

geom_text(aes(label='Annotation'), size=10, color='black', vjust=0.5, hjust=0.5) + \

scale_fill_gradient(low='white', high='blue') + \

ggtitle('Confusion Matrix at threshold 0 (training set)') + \

xlab('Predicted') + \

ylab('Actual') + \

coord_fixed(ratio=1) + \

theme_minimal() + \

theme(

legend_position='right',

plot_margin=0 # FIX: Remove element_blank() and use 0

)

# Confusion Matrix for the training set

conf_matrix_test_opt = confusion_matrix(y_test_binary, y_pred_optimized)

# Extract TP, FP, FN, TN from confusion matrix

TN_test, FP_test, FN_test, TP_test = conf_matrix_test_opt.ravel()

# Print the counts

print(f"True Negatives (TN) (Test): {TN_test}")

print(f"False Positives (FP) (Test): {FP_test}")

print(f"False Negatives (FN) (Test): {FN_test}")

print(f"True Positives (TP) (Test): {TP_test}")

# Convert confusion matrix to a DataFrame

conf_matrix_df_test_opt = pd.DataFrame(

conf_matrix_test_opt,

columns=["Predicted -1", "Predicted 1"],

index=["Actual -1", "Actual 1"]

)

# Melt the confusion matrix DataFrame to long format

conf_matrix_long_test_opt = conf_matrix_df_test.reset_index().melt(id_vars="index", value_vars=["Predicted -1", "Predicted 1"])

conf_matrix_long_test_opt.columns = ["Actual", "Predicted", "Count"]

# Define a mapping of coordinates to labels

label_map = {

("Actual -1", "Predicted -1"): "TN",

("Actual -1", "Predicted 1"): "FP",

("Actual 1", "Predicted -1"): "FN",

("Actual 1", "Predicted 1"): "TP",

}

# Add annotations for TP, FP, FN, TN counts

conf_matrix_long_test_opt['Annotation'] = conf_matrix_long_test_opt.apply(

lambda row: f"{label_map[(row['Actual'], row['Predicted'])]}: {row['Count']}", axis=1

)

# Create confusion matrix plot with Lets-Plot

conf_matrix_plot_test_opt = ggplot(conf_matrix_long_test_opt, aes(x='Predicted', y='Actual', fill='Count')) + \

geom_tile() + \

geom_text(aes(label='Annotation'), size=10, color='black', vjust=0.5, hjust=0.5) + \

scale_fill_gradient(low='white', high='blue') + \

ggtitle('Confusion Matrix (test set)') + \

xlab('Predicted') + \

ylab('Actual') + \

coord_fixed(ratio=1) + \

theme_minimal() + \

theme(

legend_position='right',

plot_margin=0 # FIX: Remove element_blank() and use 0

)

g=gggrid([conf_matrix_plot_train_opt,conf_matrix_plot_test_opt],ncol=2)

g+=ggsize(1400,800)

g.show()True Negatives (TN): 0

False Positives (FP): 26

False Negatives (FN): 0

True Positives (TP): 20

True Negatives (TN) (Test): 0

False Positives (FP) (Test): 5

False Negatives (FN) (Test): 1

True Positives (TP) (Test): 15

Looking at the updated metrics with the optimal threshold of 0, here is what we can deduce:

Model Behavior Analysis

The model has a fundamental issue with directionality. Setting the threshold to 0 essentially inverts the model’s predictions compared to the default 0.5 threshold, which explains the dramatic improvement in test metrics.

At threshold = 0: 1. Test precision improved from NaN to 0.75 2. Test recall improved from 0.0 to 0.9375 3. Test F1 score improved from 0.0 to 0.833

This is a clear indication that the model has learned relationships that have reversed between training and test periods. Looking at the ROC-AUC of 0.425 (below 0.5) confirms this - the model is making predictions that are worse than random, but consistently in the opposite direction.

What’s happening?

When we set the threshold to 0, we’re essentially saying “predict an increase for all instances” since every probability will be ≥ 0. This works because:

- Our test set is heavily imbalanced (76% rate increases)

- The model is systematically wrong about which direction the rates will move

The PR curve for the test set shows initially high precision but with unstable performance - the multiple steep drops indicate points where our model is making confident but incorrect predictions.

Economics Interpretation

This pattern suggests a fundamental regime change in UK monetary policy between our training and test periods:

- The relationships between economic indicators and interest rate decisions appear to have flipped

- Variables that previously signaled rate decreases now signal increases (or vice versa)

This aligns with what we know about UK monetary policy shifts since 1997, particularly: - Post-2008 financial crisis response - Post-Brexit policy adjustments - Recent inflation-fighting rate increases after a long period of dovish policy

Optimal Threshold Recommendation

While 0 works better than 0.5, this is not a reliable model - it’s just capturing the dominant class in the test set (increases). The balanced accuracy of 0.469 at threshold=0 is actually worse than random (0.5).

For a proper threshold, we need to:

- Reconsider the model entirely - the current one has learned patterns that don’t generalize

- Split the data differently to account for regime changes

- If we must use this model, a threshold around 0.3-0.4 might provide better balanced accuracy than 0 or 0.5

Where could we go from here?

- Treat this as a regime-shift problem rather than a threshold problem

- Try inverse features - if relationships flipped, explicitly model this by inverting some of the predictors

- Use separate models for different monetary policy regimes

- Add regime indicators as features (e.g., “post-financial crisis,” “post-Brexit”)

This is a classic example of how traditional machine learning approaches can struggle with economic data when underlying policy regimes change. The poor generalization isn’t just a technical issue - it’s revealing meaningful economic information about how the Bank of England’s decision-making process has evolved over time.

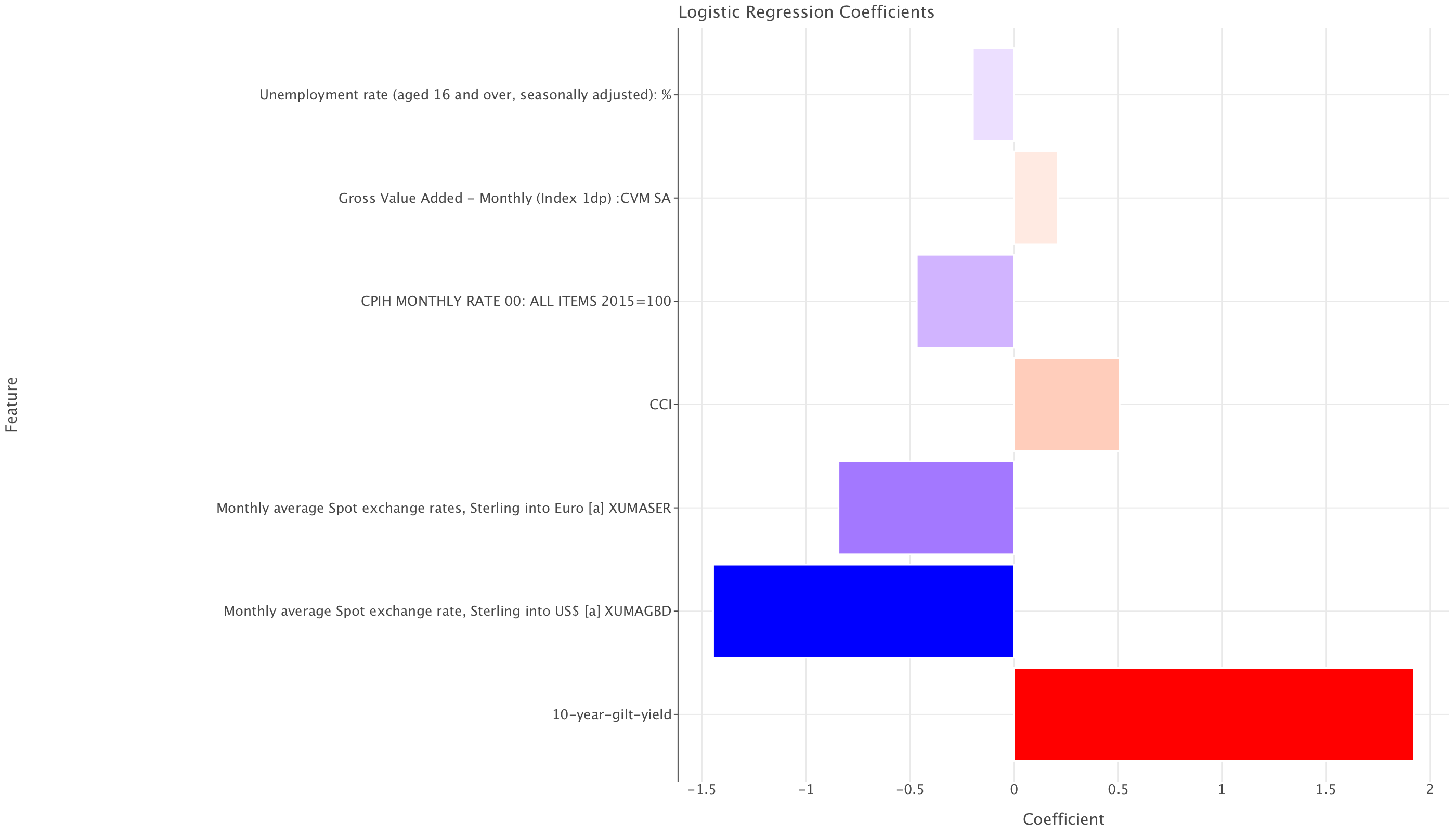

Analysis of logistic regression coefficients

Let’s have a quick look at the model’s coefficients

# Get feature names and coefficients

feature_names = X_train.columns # Assuming X_train is a DataFrame

coefficients = model.coef_[0] # model.coef_ returns a 2D array; we extract the first row

# Store in a DataFrame

coef_df = pd.DataFrame({'Feature': feature_names, 'Coefficient': coefficients})

# Sort by absolute value (strongest predictors first)

coef_df['Abs_Coefficient'] = coef_df['Coefficient'].abs()

coef_df = coef_df.sort_values(by='Abs_Coefficient', ascending=False).drop(columns=['Abs_Coefficient'])

# Display coefficients

print(coef_df)Feature Coefficient

2 10-year-gilt-yield 1.923326

5 Monthly average Spot exchange rate, Sterling i... -1.446722

6 Monthly average Spot exchange rates, Sterling ... -0.843968

0 CCI 0.507416

3 CPIH MONTHLY RATE 00: ALL ITEMS 2015=100 -0.467677

4 Gross Value Added - Monthly (Index 1dp) :CVM SA 0.210511

1 Unemployment rate (aged 16 and over, seasonall... -0.197908# Plot coefficients as a bar chart

coef_plot = ggplot(coef_df, aes(x='Feature', y='Coefficient', fill='Coefficient')) + \

geom_bar(stat='identity', show_legend=False) + \

coord_flip() + \

ggtitle('Logistic Regression Coefficients') + \

scale_fill_gradient2(midpoint=0, low='blue', mid='white', high='red') + \

ggsize(1400,800)

# Show plot

coef_plot.show()

In a logistic regression model, the coefficients represent the log-odds of the target variable (rate change) occurring for a one-unit increase in each predictor, assuming all other variables remain constant. The formula for interpreting the coefficients is:

The formula for interpreting the coefficients is:

\(\textrm{Odds Ratio} = e^{\beta}\)

Where \(\beta\) is the coefficient. The odds ratio tells us how much the odds of a rate hike change for a one-unit increase in the corresponding feature.

Interpreting Each Coefficient

Let’s compute the odds ratios and interpret what they mean:

| Feature | Coefficient (\(\beta\)) | Odds Ratio (\(e^{\beta}\)) | Interpretation |

|---|---|---|---|

| 10-year gilt yield | +1.92 | 6.83 | A 1% increase in the 10-year gilt yield makes a rate hike 6.83 times more likely. |

| Spot Exchange Rate (Avg, Sterling per $) | -1.45 | 0.23 | A 1 unit increase (i.e., stronger pound against the dollar) makes a rate hike 77% less likely. |

| Spot Exchange Rate (Sterling per Euro) | -0.84 | 0.43 | A 1 unit increase (stronger pound against the Euro) makes a rate hike 57% less likely. |